Introduction

The UK manufacturing business marketplace is vibrant and offers a plethora of opportunities for both buyers and sellers. In 2025, the sector is witnessing a surge in mergers and acquisitions, with the Office for National Statistics reporting a 15% increase in business sales compared to the previous year. If you are looking to list a UK manufacturing business for sale, it's crucial to understand the process, valuation methods. Additionally, marketplace dynamics. This guide offers a comprehensive overview of the steps involved in selling a manufacturing business in the UK.

business for sale process framework infographic"

class="responsive-infographic"

style="max-width: 100%; height: auto; border-radius: 8px; box-shadow: 0 4px 8px rgba(0,0,0,0.1);"

loading="lazy"

crossorigin="anonymous">

business for sale process framework infographic"

class="responsive-infographic"

style="max-width: 100%; height: auto; border-radius: 8px; box-shadow: 0 4px 8px rgba(0,0,0,0.1);"

loading="lazy"

crossorigin="anonymous">

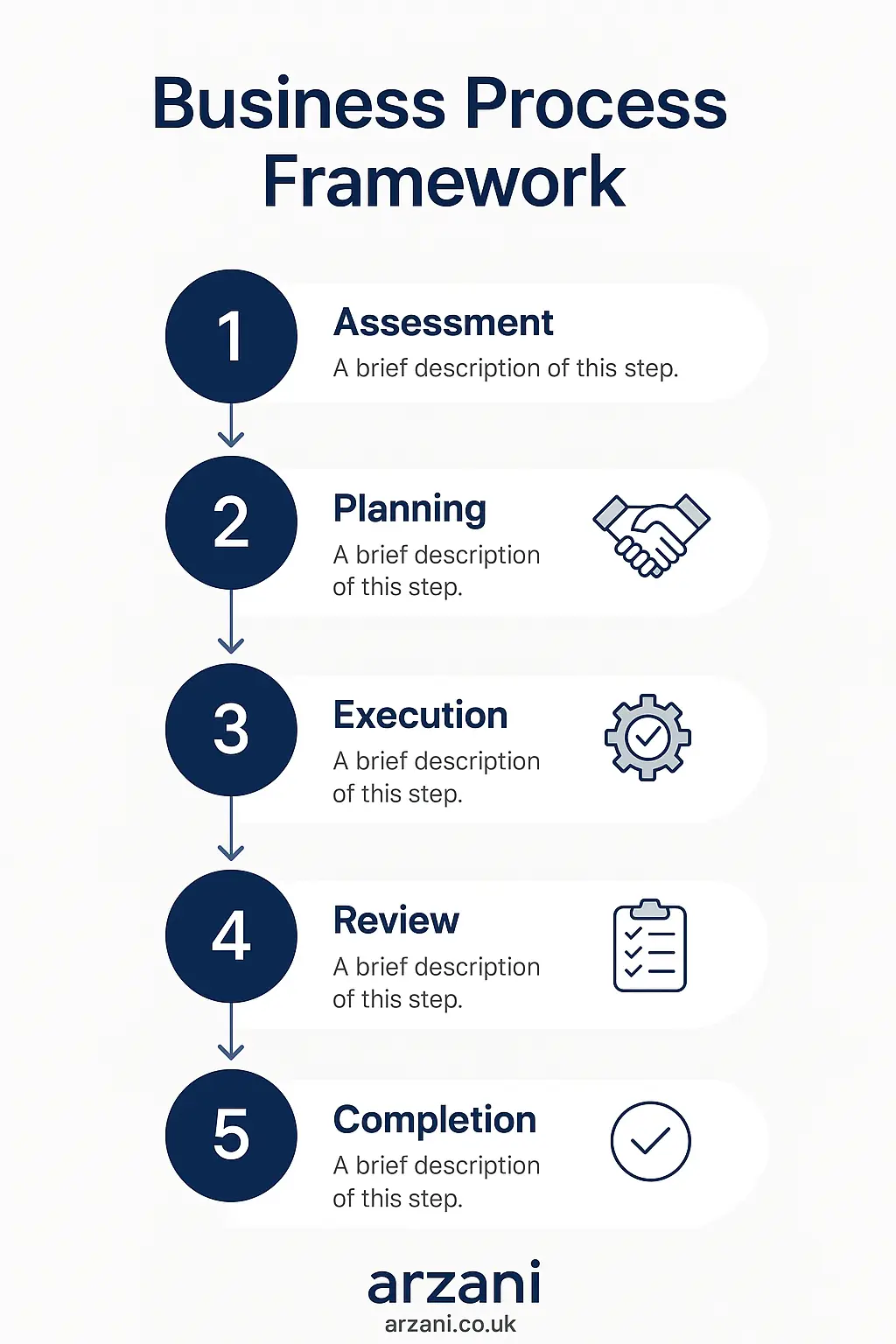

Business Process Framework - Step-by-step business uk manufacturing business for sale process framework infographic

Table of Contents

Understanding the Market

The British manufacturing business marketplace is diverse, ranging from small-scale operations to large enterprises. As of 2025, the demand for manufacturing businesses, especially those with a focus on sustainability and innovation, has increased significantly. Companies House data indicates that businesses in the Midlands and South East are particularly attractive to investors due to their strategic locations and robust supply chains.

Valuation Process

Valuing a manufacturing business in the UK involves several key steps:

- Financial Analysis: Review financial statements to assess profitability and cash flow.

- Asset Evaluation: Determine the value of tangible and intangible assets.

- Market Comparison: Compare with similar businesses recently sold on platforms like Arzani.

- Growth Potential: Analyse potential for future growth and expansion.

- Economic Conditions: Consider current economic trends affecting the manufacturing sector.

UK Market Statistics - UK uk manufacturing business for sale market statistics and data visualization

Preparing for Sale

Preparation is critical when selling a manufacturing business. Follow these steps to ensure a smooth process:

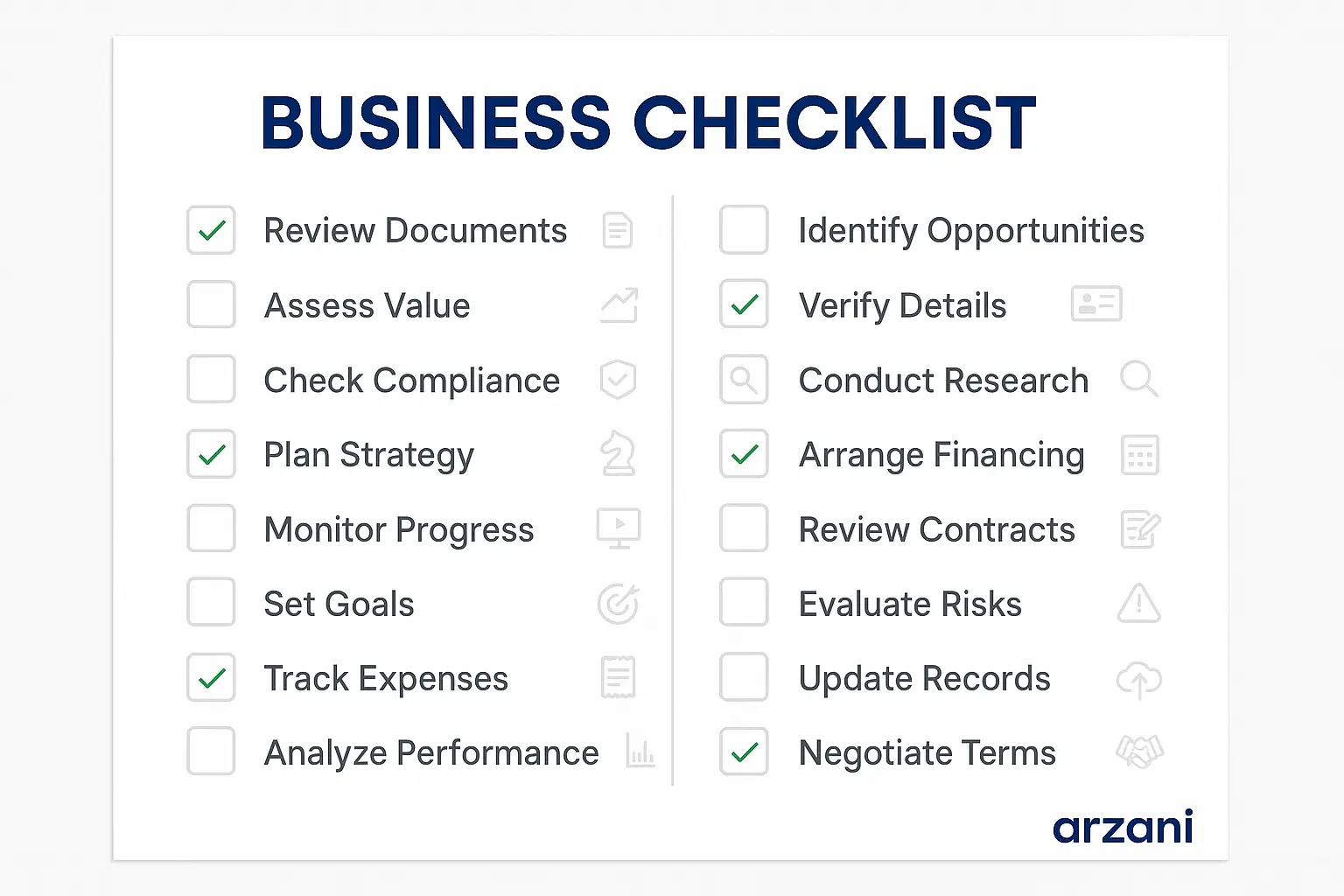

- Document Organisation: Ensure all business records are up-to-date and accessible.

- Business Presentation: Develop a compelling presentation that highlights your business's strengths.

- Legal Compliance: Verify compliance with all relevant regulations, such as those from the Financial Conduct Authority.

- Professional Valuation: Obtain a professional valuation to set a realistic asking price.

Finding Buyers

Identifying potential buyers is a crucial step in the selling process. Consider the following strategies:

- Networking: Leverage industry connections and professional networks.

- Online Listings: Use online marketplaces such as Arzani to reach a broader audience.

- Broker Services: Engage a business broker with experience in the manufacturing sector.

Negotiation Framework

Effective negotiation can significantly impact the outcome of your sale. Follow this 7-step framework for successful negotiations:

- Research: Understand the buyer's background and motivations.

- Initial Offer: Present a well-justified initial offer.

- Counter Offers: Be prepared for counter offers and maintain flexibility.

- Terms Agreement: Focus on agreeing to the key terms first.

- Due Diligence: Support the buyer's due diligence process with transparency.

- Final Agreement: Reach a mutually beneficial agreement.

- Closing: Ensure all documentation is in order for a smooth closing.

Business Timeline - Typical uk manufacturing business for sale timeline and milestones infographic

Case Studies

To illustrate successful transactions in the UK manufacturing sector, consider these anonymised case studies:

Case Study 1: Midlands Manufacturing Sale

A mid-sized manufacturing firm in Birmingham successfully sold for £3.5M. The sale was facilitated through a strategic focus on highlighting proprietary technologies and a robust customer base.

Case Study 2: South East Engineering Acquisition

An engineering business in the South East, valued at £2.8M, attracted multiple buyers due to its innovative product line and strong revenue growth. The transaction was completed within six months.

Frequently Asked Questions

What is a typical multiple for UK SMEs?

The typical earnings multiple for UK SMEs ranges between 3x to 5x EBITDA, depending on the sector and market conditions.

How long does it take to sell a manufacturing business?

On average, it takes six to twelve months to sell a manufacturing business, though this can vary based on market conditions and preparation.

What legal documents are required?

Key documents include the sales agreement, confidentiality agreements, and financial statements, among others.

How can I increase my business's value before selling?

Enhancing operational efficiency, expanding market presence, and maintaining strong financial records are effective strategies.

Should I hire a broker?

Hiring a broker can provide access to a wider network of potential buyers and professional negotiation expertise.

Business Checklist - uk manufacturing business for sale checklist and key considerations infographic

Conclusion & CTA

Selling a UK manufacturing business requires thorough preparation and strategic execution. By understanding the market, accurately valuing your business. Additionally, effectively negotiating, you can maximise the sale's success. For further assistance, explore Arzani's marketplace for a comprehensive suite of resources and expert guidance. Connect with our team today to list your business and tap into a world of opportunities.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv