Introduction

The UK market for business sales is flourishing, with the value of transactions consistently on the rise. According to the Office for National Statistics, the number of successful business sales increased by 12% in 2024, signalling robust activity in this sector. When considering the sale of a business, owners are often faced with two principal options: a management buyout or an external sale. Understanding the nuances of each can significantly influence the outcome of the transaction.

Business Process Framework - Step-by-step business management buyout vs external sale uk process framework infographic

Table of Contents

Understanding Management Buyouts

A management buyout (MBO) involves a company's existing management team acquiring a large portion or all of the business. This option is often attractive because it allows for continuity and can be less disruptive. In 2025, Companies House reported that MBOs accounted for 25% of all business sales in the UK, underscoring their popularity.

The UK Management Buyout Process

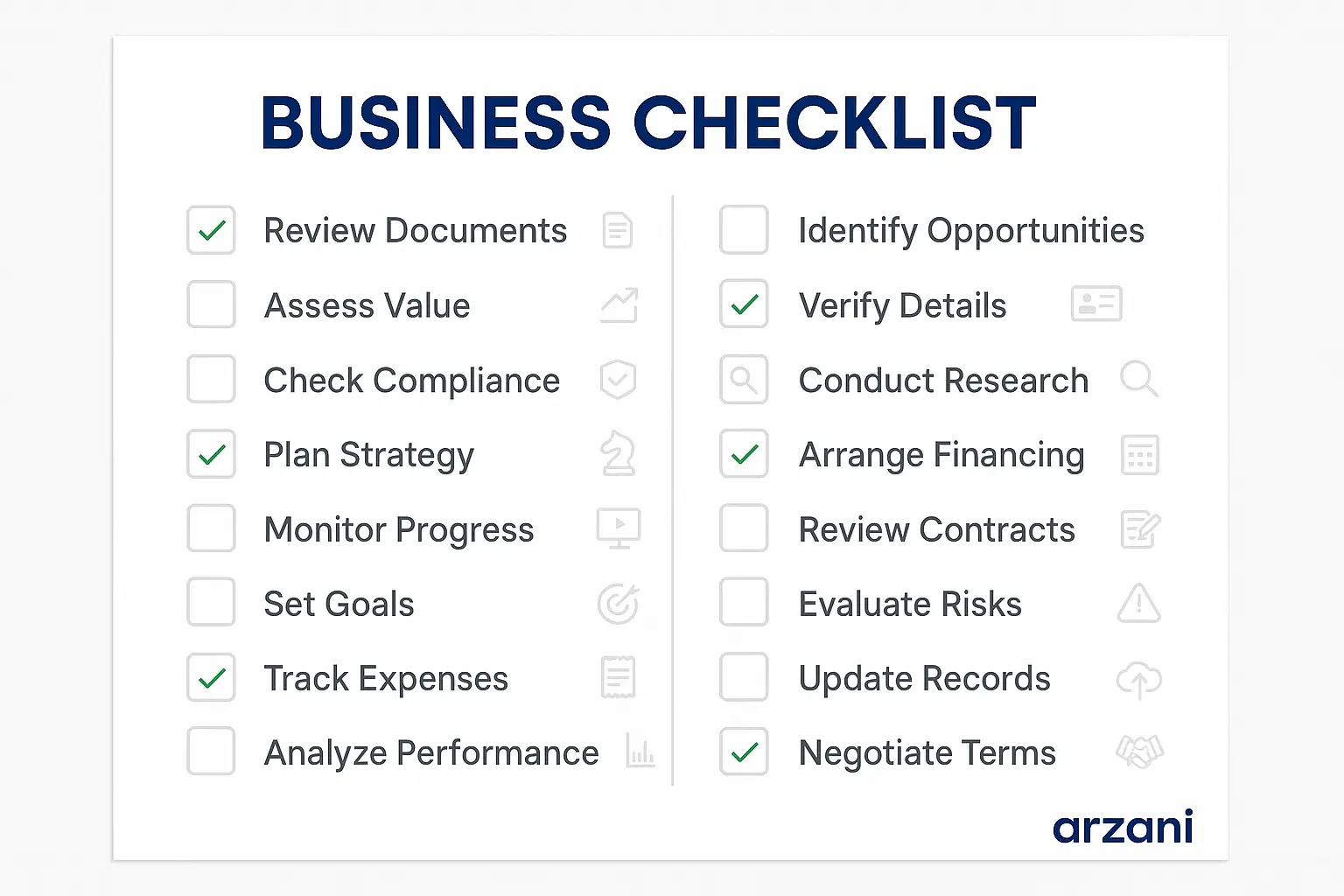

- Assess Feasibility: Determine if the management team has the financial backing and capability to take over the business.

- Valuation: Conduct a thorough business valuation to ensure a fair price is agreed upon. This often involves hiring external experts.

- Financing: Secure financing, which might include loans or equity funding. The HMRC provides guidance on tax implications of funding options.

- Negotiation: Negotiate terms of purchase, including price and payment structure.

- Due Diligence: Perform comprehensive due diligence to confirm financial health and operational viability.

- Legal Documentation: Draft and sign legal documents to formalise the transaction.

- Transition Planning: Develop a plan to transition ownership smoothly, maintaining operational stability.

Exploring External Sales

In contrast, an external sale involves selling the business to an outside buyer. This could be another company, a private equity firm, or an individual investor. External sales can potentially offer higher valuations, as they might attract competitive bids.

External Sale Advantages UK

- Broader Market Access: Attracts a wider audience, potentially leading to a higher sale price.

- Strategic Alignments: Often results from strategic alignments, offering synergies that can justify premium valuations.

- Cash Out: Provides an opportunity for full immediate cash out, appealing to owners looking to exit completely.

UK Market Statistics - UK management buyout vs external sale uk market statistics and data visualization

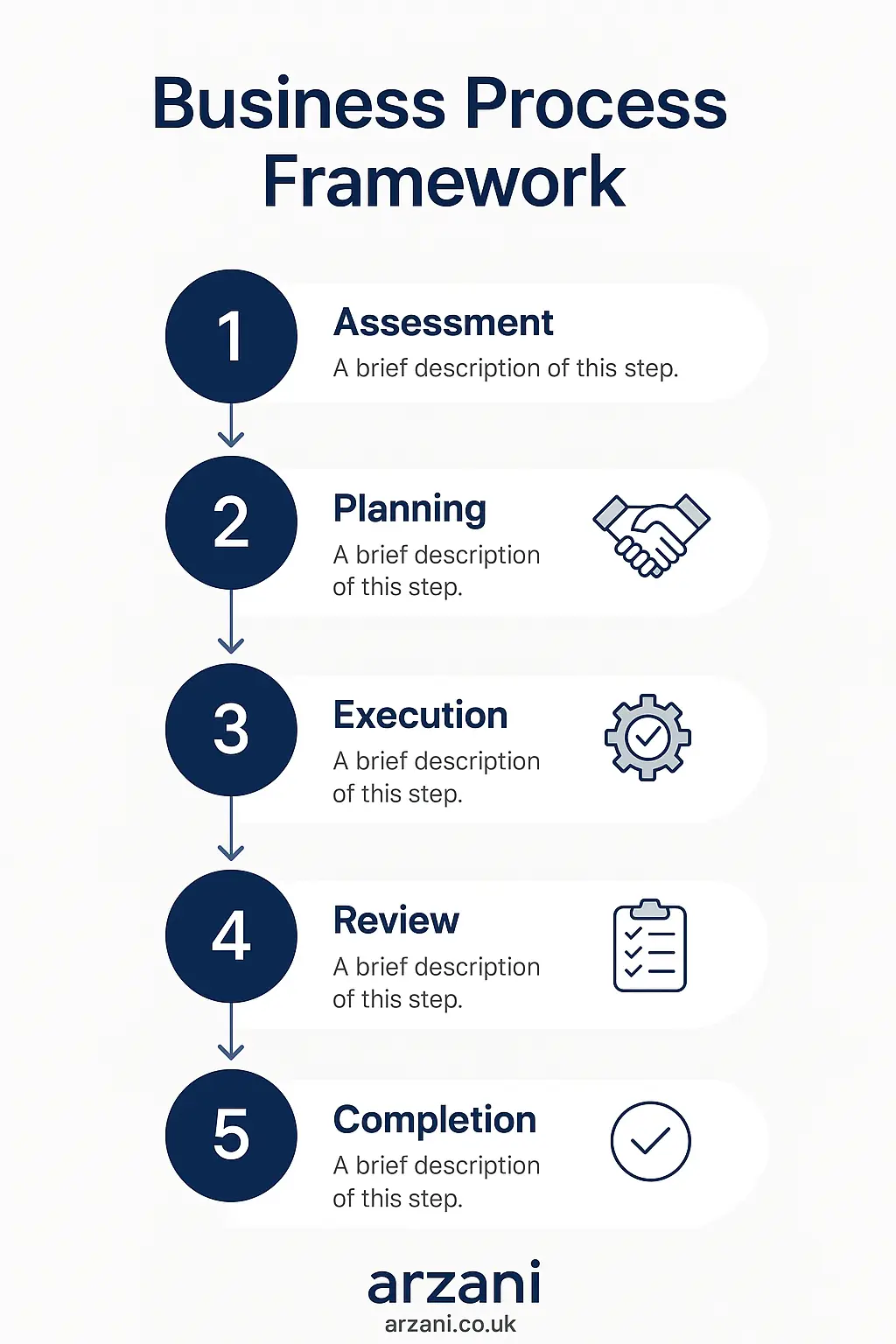

7-Step Business Selling Framework

Whether opting for an MBO or an external sale, a structured approach is critical to the transaction's success. Here's a 7-step framework to guide business owners through the selling process:

- Strategic Planning: Define your objectives and prepare a comprehensive business plan that highlights strengths and future potential.

- Valuation: Obtain a professional valuation to guide your asking price and negotiations.

- Market Research: Understand market conditions and identify potential buyers.

- Marketing Strategy: Develop a strategy to market your business effectively to potential buyers.

- Buyer Screening: Evaluate potential buyers to ensure they have the financial capability and intent to complete the purchase.

- Negotiation: Engage in negotiations to agree on terms that meet both parties' needs.

- Closing: Finalise the sale with thorough legal oversight to ensure compliance with UK regulations.

Detailed Case Studies

Let’s review some anonymised case studies from the Arzani marketplace:

Case Study 1: Manufacturing Sector

A manufacturing firm in Leeds with a valuation of £1.8M was successfully sold via management buyout. The management team secured funding through local financial institutions, ensuring a seamless transition and continued operational success.

Case Study 2: Retail Industry

A retail business in Birmingham opted for an external sale, attracting multiple bids. The final transaction closed at £2.5M, 30% above the initial valuation, due to strategic interest from regional competitors.

Business Timeline - Typical management buyout vs external sale uk timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

The typical earnings multiple for SMEs in the UK ranges from 3 to 5, depending on industry, growth prospects, and economic conditions.

How long does a business sale process take?

A business sale can take anywhere from 6 to 12 months, factoring in valuation, marketing, negotiation, and legal processes.

What are the tax implications of selling my business?

The tax implications can vary. Business owners should consult with tax professionals to understand liabilities under HMRC guidelines.

Can I sell a part of my business?

Yes, partial sales are possible and can be beneficial for owners looking to retain some control or future income potential.

What role does due diligence play in the selling process?

Due diligence is crucial as it verifies the business’s financial and operational health, assuring the buyer of their investment's viability.

Business Checklist - management buyout vs external sale uk checklist and key considerations infographic

Conclusion & CTA

Choosing between a management buyout and an external sale in the UK involves evaluating numerous factors, including financial goals, market conditions. Additionally, future involvement with the business. Both paths have their unique advantages and potential challenges. For personalised advice tailored to your specific situation, consider consulting the Arzani marketplace. Here, you can explore a wide range of resources and connect with experts to facilitate your business transaction.

Ready to take the next step? Visit arzani.co.uk and start your journey towards a successful business sale today.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv