Introduction

In 2025, the UK healthcare industry is witnessing a robust trend of mergers and acquisitions, with over £10 billion in transactions recorded last year alone (source: ONS). Navigating the intricate landscape of UK healthcare business sale regulations is crucial for both buyers and sellers. Understanding these regulations ensures compliance and maximises value during transactions. This comprehensive guide will delve into the key aspects of selling a healthcare business in the UK, providing actionable insights into regulatory compliance and strategic planning.

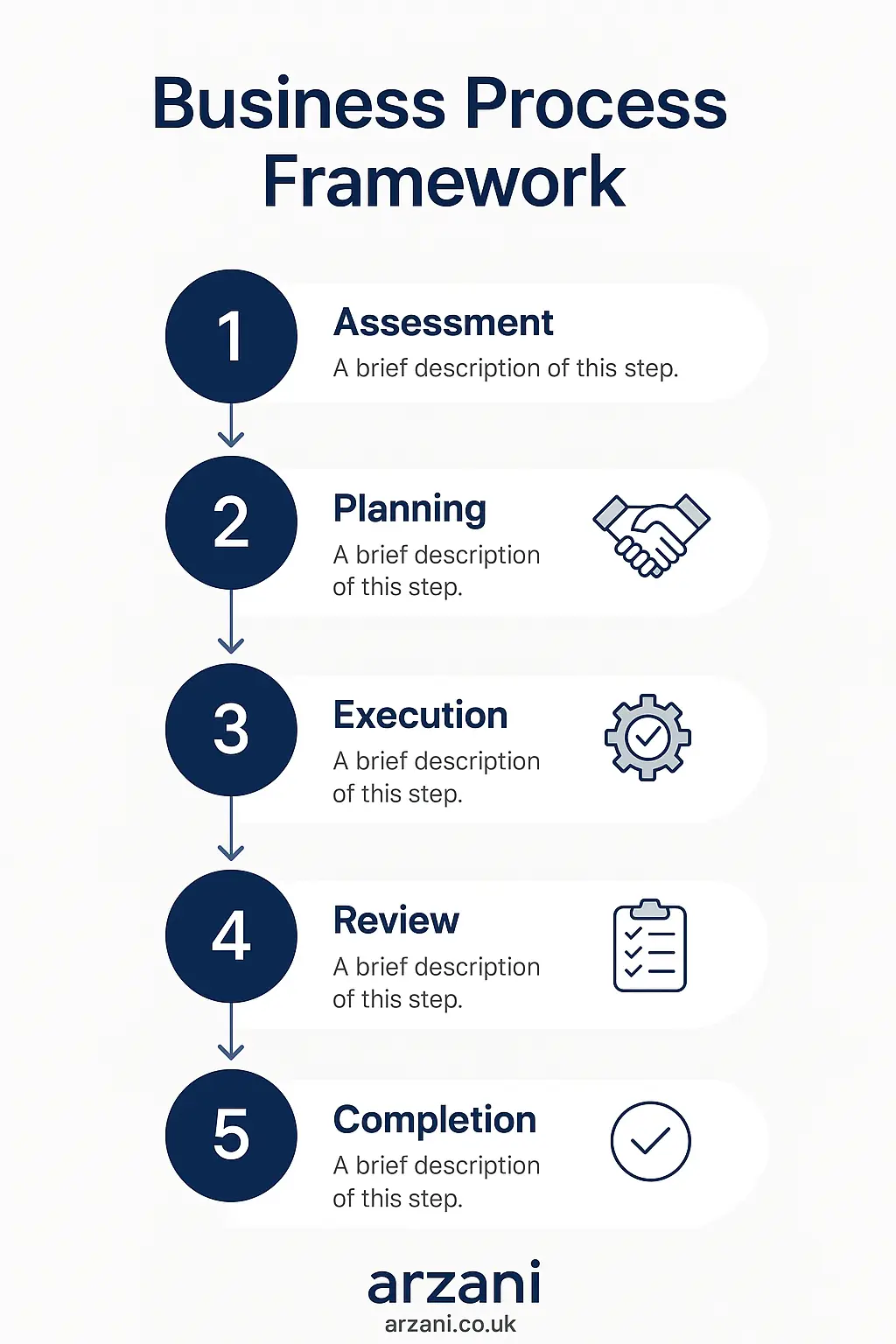

Business Process Framework - Step-by-step business uk healthcare business sale regulations process framework infographic

Table of Contents

Understanding UK Healthcare Regulations

The UK healthcare sector is tightly regulated, with specific rules governed by entities such as the Care Quality Commission (CQC) and the Companies House. Compliance with these regulations is non-negotiable when considering the sale or purchase of a healthcare business. Here, we outline the essential regulatory frameworks impacting business sales:

- Care Quality Commission (CQC) Standards: Ensuring that healthcare providers meet mandatory standards of quality and safety.

- Data Protection Regulations: Adherence to GDPR to protect patient data during the transaction.

- Employment Law Compliance: Understanding TUPE regulations for the transfer of staff.

- HMRC Tax Obligations: Ensuring correct reporting and taxation during the sale process.

7-Step Business Sale Process

Selling a healthcare business involves a structured approach to ensure compliance and maximise value. Here's a detailed 7-step process:

- Initial Assessment: Evaluate the business's readiness for sale, including compliance with all relevant regulations.

- Valuation: Determine the business's market value using industry-standard methods.

- Preparation of Documentation: Compile necessary documents such as financial statements, CQC reports, and employee contracts.

- Marketing the Business: Use platforms like Arzani Marketplace to reach potential buyers.

- Engaging with Buyers: Conduct due diligence and negotiate terms with interested parties.

- Finalising the Sale: Draft and sign the sale agreement, ensuring all regulatory approvals are in place.

- Post-Sale Integration: Assist with the transition phase to ensure seamless operations for the new owner.

UK Market Statistics - UK uk healthcare business sale regulations market statistics and data visualization

Case Studies of Successful Healthcare Business Sales

Real-world examples provide valuable insights into the nuances of healthcare business sales:

Case Study 1: A London-based private clinic was sold for £2.5 million. The transaction highlighted the importance of a comprehensive valuation and robust compliance with CQC standards.

Case Study 2: A dental practice in Manchester was acquired by a national chain for £1.8 million. This sale underscored the significance of employee retention strategies during the transition.

Business Timeline - Typical uk healthcare business sale regulations timeline and milestones infographic

Frequently Asked Questions

How is a healthcare business valued in the UK?

Valuation typically considers financial performance, market position, and regulatory compliance. Industry multiples can range from 3x to 6x EBITDA, depending on the business's specific attributes.

What are the key regulations affecting healthcare business sales?

The CQC standards, GDPR compliance, and employment law, particularly TUPE, are critical. Each impacts various facets of the transaction process.

Can foreign investors buy UK healthcare businesses?

Yes, foreign investors can purchase UK healthcare businesses, provided they comply with UK regulatory standards and acquire necessary approvals.

How long does it take to sell a healthcare business?

The process can take from six months to over a year, depending on the business size, market conditions, and regulatory complexities.

What are common challenges in selling a healthcare business?

Regulatory compliance, maintaining patient confidentiality, and securing employee retention are common hurdles.

Business Checklist - uk healthcare business sale regulations checklist and key considerations infographic

Conclusion & Call to Action

Successfully navigating the sale of a healthcare business in the UK requires an in-depth understanding of regulations and strategic planning. By following our 7-step process, sellers can enhance compliance, attract suitable buyers. Additionally, achieve optimal sale outcomes. For expert guidance and access to a network of potential buyers, visit Arzani Marketplace today and start your business sale journey with confidence.

Author Bio: As an expert in the UK business marketplace with over 15 years of experience, I have facilitated numerous healthcare transactions, ensuring compliance and maximising value for all parties involved. My insights are informed by direct involvement in the sale of businesses ranging from small clinics to large healthcare organisations.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv