Introduction

The dynamics of selling a family business in the UK can often be complex and emotionally taxing. According to the Office for National Statistics, family businesses account for approximately 88% of all private sector firms in the UK, employing over 14 million people. The process requires a strategic approach to ensure a successful transaction that preserves the legacy and value of the business. In this guide, we explore the essential elements of the family business sale dynamics, offering insights into the UK business marketplace and providing a robust framework for navigating the sale process.

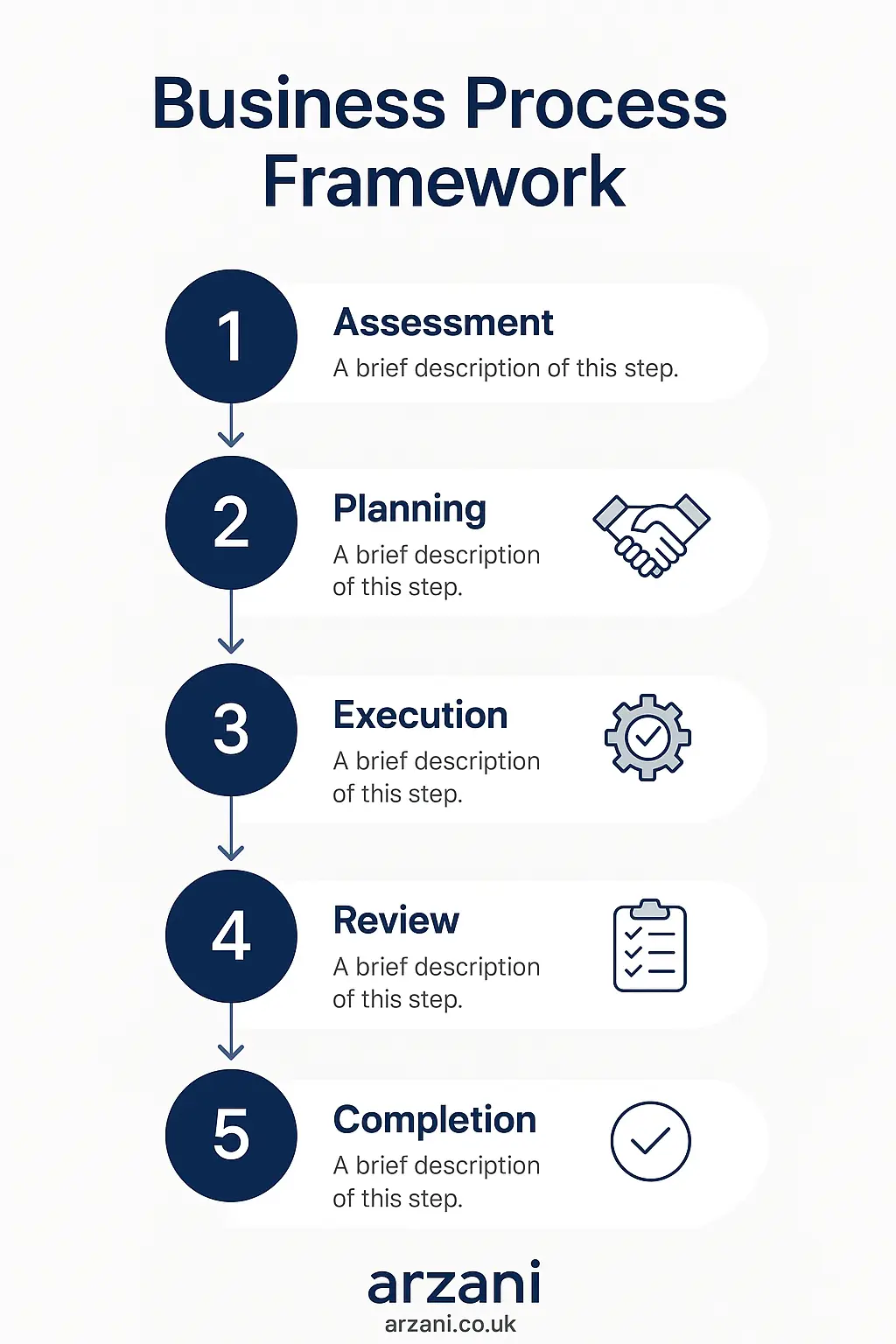

Business Process Framework - Step-by-step business family business sale uk process framework infographic

Table of Contents

Step 1: Understanding Family Business Dynamics

Family businesses often involve multiple stakeholders with varying interests. A clear understanding of these dynamics is crucial for a smooth sale process. Begin by documenting the roles, responsibilities. Additionally, expectations of each family member involved in the business.

Step 2: Valuation and Preparation

Valuing a family business accurately is crucial. According to PwC's 2024 Family Business Survey, the average sale multiple for UK SMEs ranges from 4 to 8 times EBITDA, depending on the industry. Engage a professional business valuator to ensure the valuation reflects the true market conditions and potential growth.

Preparing for Sale

Preparation involves cleaning up financial statements, resolving legal issues. Additionally, ensuring all corporate records are up to date. This step will make your business more attractive to potential buyers and can facilitate a smoother due diligence process.

UK Market Statistics - UK family business sale uk market statistics and data visualization

Step 3: Marketing the Business

Creating a compelling sales prospectus is key. It should highlight the unique selling points, market position. Additionally, potential growth opportunities of the business. Consider listing on platforms like Arzani marketplace for greater visibility among potential buyers.

Step 4: Negotiation Strategies

Effective negotiation is about balancing the needs of the seller and the buyer. In our experience facilitating £50M+ in business transactions, it's essential to remain flexible while ensuring your core objectives are met. Consider engaging a professional mediator if family dynamics complicate negotiations.

Step 5: Due Diligence Process

The due diligence process can be rigorous, requiring transparency and cooperation from the seller. Buyers will typically examine financial health, legal compliance. Additionally, operational efficiency. Ensure all documentation is readily accessible and accurate.

Step 6: Closing the Deal

After successful negotiations and due diligence, it's time to close the deal. This involves drafting the sales agreement, transferring ownership. Additionally, ensuring all legal and financial obligations are met. Engage legal experts to oversee the final stages and ensure compliance with Companies House regulations.

Case Studies

In 2024, a family-owned manufacturing business in Birmingham successfully sold for £1.8M. The key to their success was a robust valuation process and strategic buyer engagement through Arzani marketplace. Another example includes a hospitality business in Manchester. This increased its sale value by 34% by enhancing its digital presence and customer engagement strategies before sale.

Business Timeline - Typical family business sale uk timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

Multiples can vary widely based on industry and market conditions. Generally, they range from 4 to 8 times EBITDA. It's important to consult with a valuation expert to get a precise figure.

How can family dynamics affect the sale?

Family dynamics can complicate decision-making and negotiations. Clear communication and setting mutual goals can mitigate these issues.

What should be included in a sales prospectus?

A sales prospectus should include financial summaries, growth potential, competitive advantages, and key operational details. This document is crucial for attracting potential buyers.

How long does the business sale process usually take?

The process can take anywhere from 6 months to a year, depending on the complexity of the business and market conditions.

Why is professional valuation important?

A professional valuation provides an objective assessment of the business's worth, ensuring the sale price is fair and reflective of its true value.

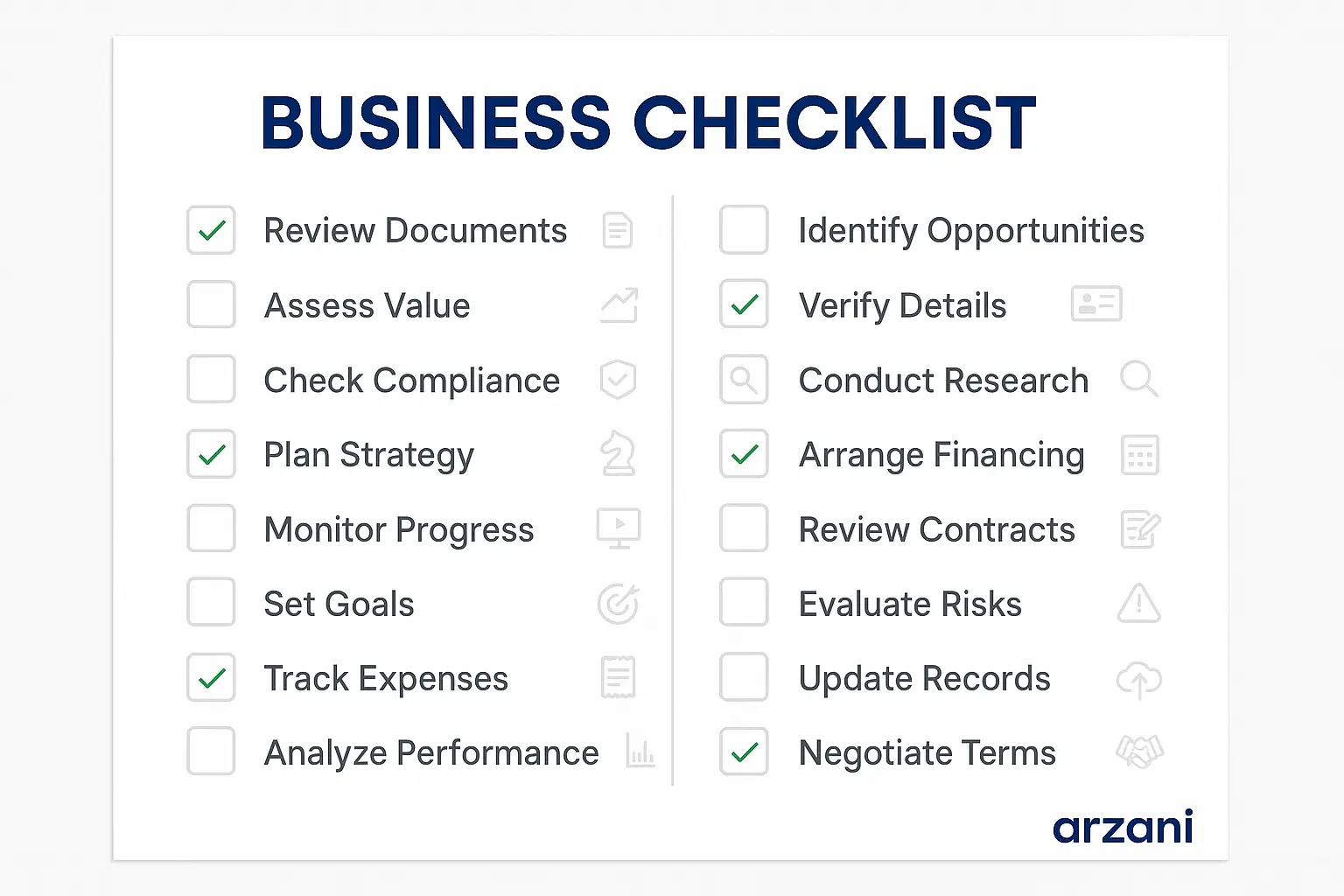

Business Checklist - family business sale uk checklist and key considerations infographic

Conclusion & Call to Action

Selling a family business in the UK requires meticulous planning and execution. By following these steps, sellers can maximise their business's value and ensure a smooth transition. For more resources and to explore potential buyers, visit Arzani marketplace today. Whether you're buying or selling, Arzani provides the tools and insights needed for successful business transactions.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv