Introduction

The market multiple business valuation approach is a cornerstone method for understanding the value of a company in the UK, where the business landscape continues to evolve rapidly. Recent data from the Office for National Statistics indicates that mergers and acquisitions remain robust, with an estimated £300 billion in transactions recorded in 2025. This article explores the intricacies of using market multiples to value businesses, offering insights into buying and selling within the UK marketplace.

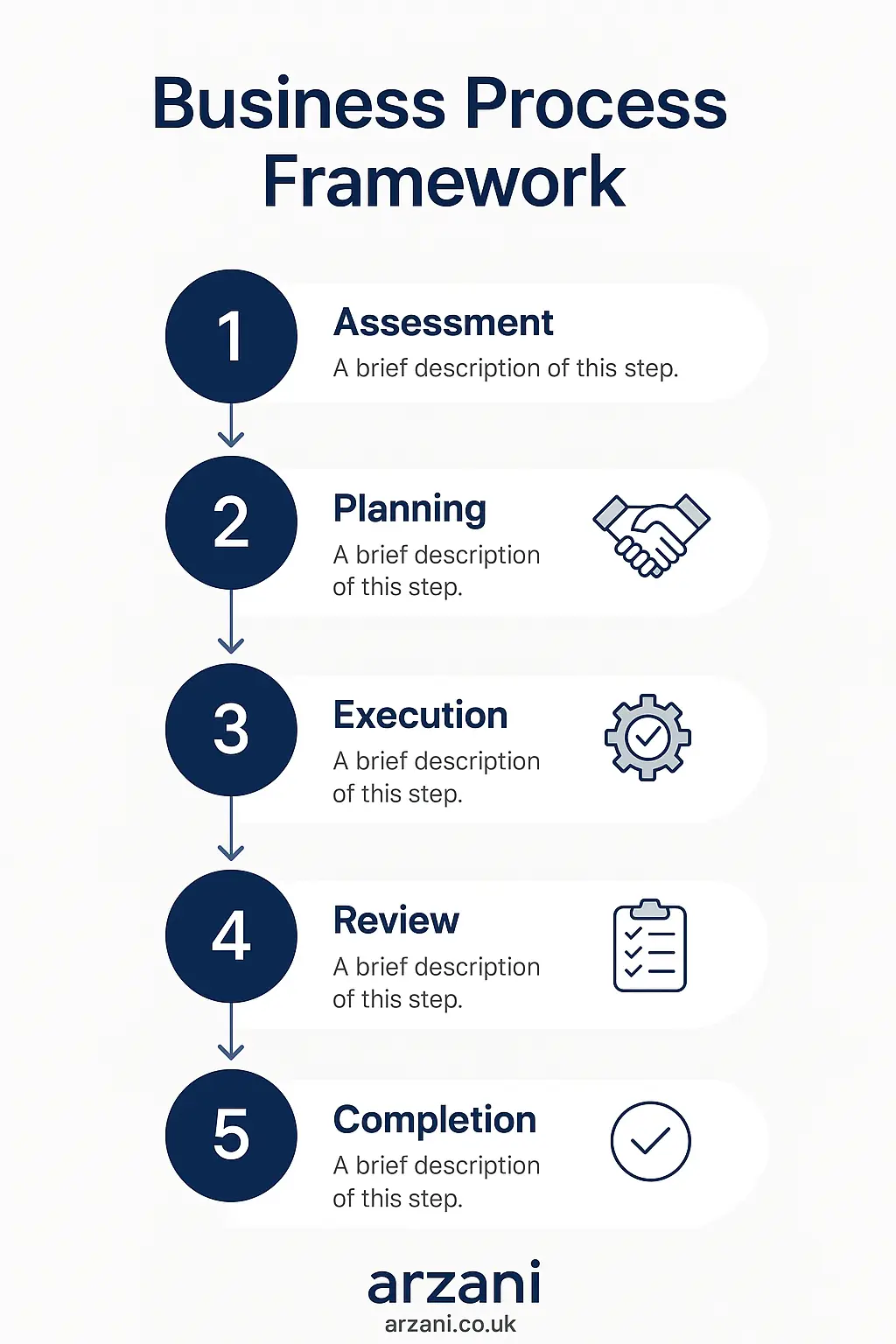

Business Process Framework - Step-by-step business market multiple business valuation process framework infographic

Table of Contents

Understanding Market Multiples

Market multiples are valuation tools that compare a company’s financial metrics with those of similar companies. These include P/E ratios, EBITDA multiples. Additionally, revenue multiples. In the business valuation UK context, these multiples provide a quick and efficient means to estimate a company's value relative to its peers.

7-Step Business Valuation Framework

-

Identify Comparable Companies

Begin by identifying companies similar in size, sector, and growth trajectory. This step is critical in ensuring your valuation is grounded in realistic market conditions.

-

Determine Relevant Multiples

Select appropriate financial metrics, such as P/E or EV/EBITDA, depending on the industry. These metrics vary by sector. for example, tech companies often rely on revenue multiples.

-

Gather Data

Use reliable sources such as Companies House and financial databases to gather historical and current data on these metrics.

-

Adjust for Differences

Adjust the multiples for any differences in size, risk, or growth potential between the target company and its comparables.

-

Apply the Multiples

Apply the adjusted multiples to the target company’s financial metrics to estimate its value.

-

Consider Contextual Factors

Assess the impact of current economic conditions, regulatory changes. Additionally, market trends on the valuation. For instance, Brexit has introduced new variables in UK business valuations.

-

Review and Refine

Finally, review the valuation results with stakeholders and refine as needed, ensuring alignment with strategic objectives.

UK Market Statistics - UK market multiple business valuation market statistics and data visualization

Key Considerations in the UK Market

When applying the market multiple approach in the UK, it's crucial to account for specific factors such as regional economic conditions, industry-specific regulations. Additionally, the impact of political changes like Brexit. The Financial Conduct Authority (FCA) provides guidelines that can influence market valuations, particularly in highly regulated industries.

Case Studies

Let's explore two anonymized UK business transaction examples that demonstrate the application of market multiples:

- Case Study 1: A £1.5M Acquisition in the Retail Sector

An online retail company in Manchester was acquired using an EBITDA multiple of 6x, reflecting its strong cash flow and strategic market position.

- Case Study 2: £3M Sale of a Manufacturing Business

A Leeds-based manufacturer was sold at a revenue multiple of 2.5x, a decision influenced by its consistent revenue growth and niche market dominance.

Business Timeline - Typical market multiple business valuation timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

Typical multiples for UK SMEs vary by industry, but generally, EBITDA multiples range from 4x to 8x for most sectors.

How does Brexit affect business valuations?

Brexit introduces uncertainties, impacting investor confidence and potentially lowering multiples due to perceived risks.

Are there specific regulations for business valuation in the UK?

While no specific regulations govern valuation methods, adherence to FCA and Companies House guidelines is recommended for compliance.

How often should a business be revalued?

Businesses should consider revaluation every 1-2 years or when significant changes occur, such as mergers or market shifts.

Can market multiples be used for all businesses?

While versatile, market multiples may not suit all businesses, particularly startups or companies with unique business models.

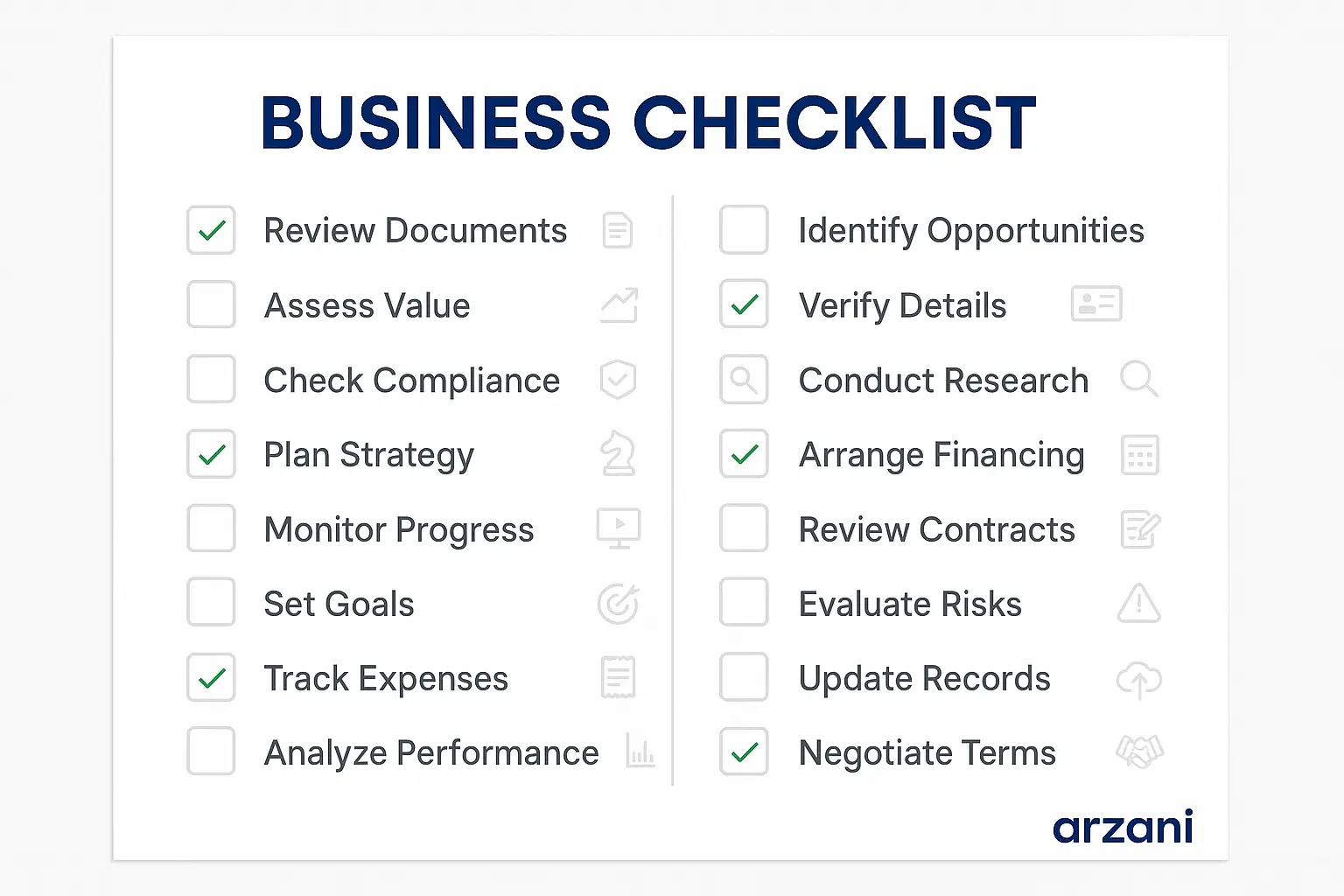

Business Checklist - market multiple business valuation checklist and key considerations infographic

Conclusion and Call to Action

Employing the market multiple business valuation approach can significantly enhance your understanding of a business's worth within the UK marketplace. By following a structured framework, you can achieve a more accurate and reliable valuation. Whether you're buying or selling a business in the UK, understanding these methodologies is crucial.

Ready to value your business or explore acquisition opportunities? Visit Arzani Marketplace to connect with industry experts and access cutting-edge valuation tools.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv