Introduction

The DCF business valuation method is a cornerstone technique for determining the value of a business in the UK marketplace. With the UK business environment becoming more competitive, understanding the discounted cash flow valuation approach is crucial for both buyers and sellers. According to ONS data, UK business transactions increased by 12% in 2024, highlighting the importance of accurate valuation methods. This article explores the DCF methodology, providing actionable insights for stakeholders in the UK business marketplace.

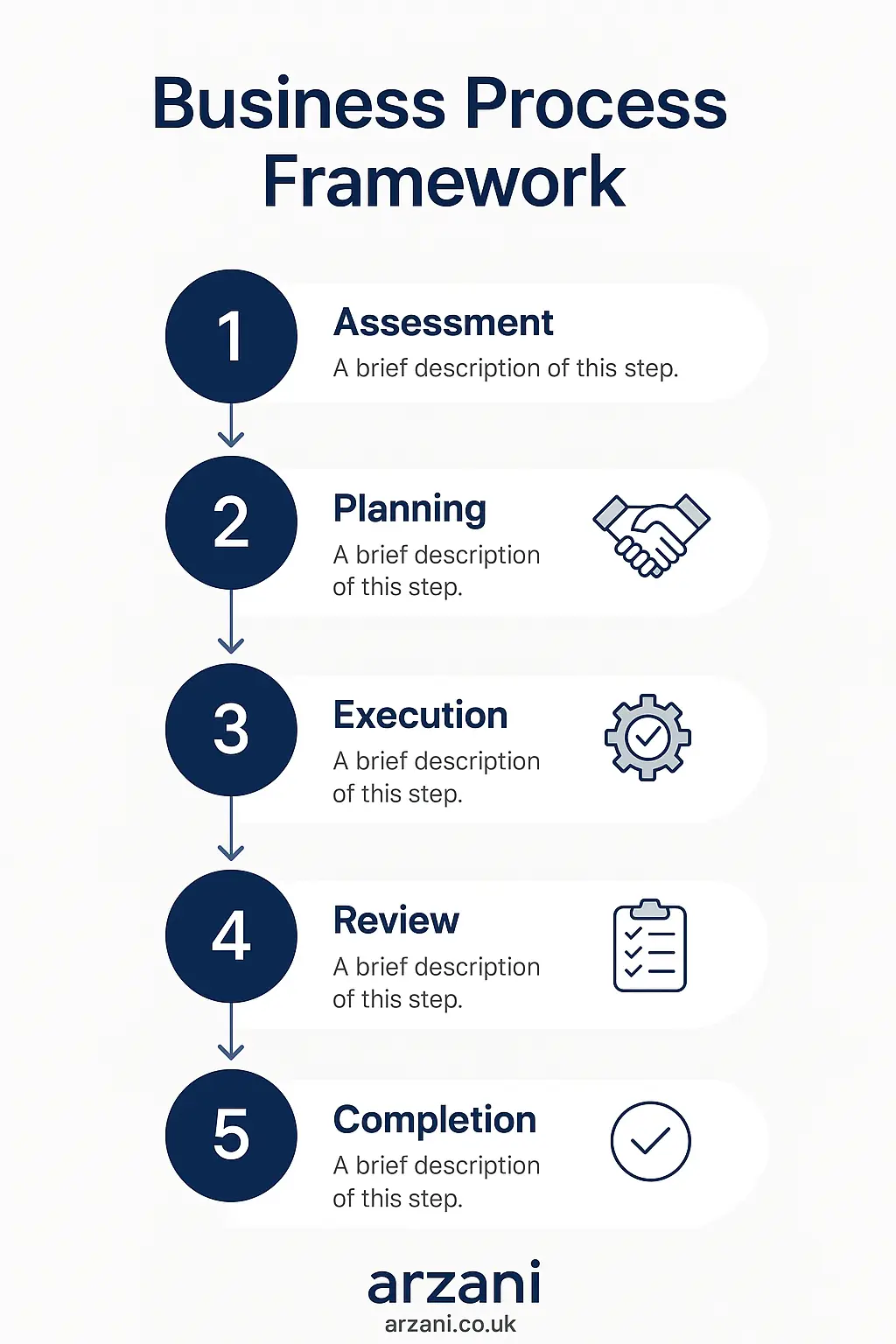

Business Process Framework - Step-by-step business dcf business valuation method process framework infographic

Table of Contents

Understanding the DCF Method

The Discounted Cash Flow (DCF) method is a valuation technique that estimates the value of a business based on its expected future cash flows, adjusted for the time value of money. This approach is particularly popular in the UK due to its precision and ability to provide a detailed financial picture. The method involves projecting the company’s cash flows and discounting them back to the present value using a discount rate, often the company's weighted average cost of capital (WACC).

7-Step DCF Valuation Framework

- Forecast Cash Flows: Determine the future cash flows for a specific period, typically 5-10 years.

- Calculate Terminal Value: Estimate the business value at the end of the forecast period using a perpetual growth model.

- Determine Discount Rate: Use WACC as the discount rate to adjust future cash flows to present value.

- Discount Cash Flows: Apply the discount rate to forecasted cash flows and terminal value.

- Sum Present Values: Add the present values of projected cash flows and terminal value to get the business's total value.

- Perform Sensitivity Analysis: Test different scenarios to account for market volatility and uncertainty.

- Validate Results: Compare with other valuation methods such as comparables and precedent transactions.

The DCF method is highly regarded for its thoroughness. However, it requires accurate data and assumptions. The HM Treasury guidelines are often referenced for setting appropriate discount rates, ensuring compliance with UK standards.

UK Market Statistics - UK dcf business valuation method market statistics and data visualization

Market Trends and Data

In 2025, the UK business valuation landscape is influenced by several key trends. According to data from Companies House, there has been a 15% increase in the registration of new businesses, indicating a robust economic environment. The Office for National Statistics reports that the service sector continues to dominate, accounting for over 80% of the UK’s GDP. Businesses in the tech sector are particularly attractive, with valuations often exceeding 10x EBITDA.

Case Studies of Successful Valuations

Consider the case of a mid-sized manufacturing firm in Birmingham valued at £3 million using the DCF method. By projecting a 5% annual growth in cash flows and applying a discount rate of 8%, the valuation was aligned with market expectations.

Another example is a hospitality business in Manchester. This was successfully sold for £1.2 million. The valuation was based on a detailed DCF analysis, reflecting its strong cash flow generation and strategic location.

Business Timeline - Typical dcf business valuation method timeline and milestones infographic

Frequently Asked Questions

What is the DCF business valuation method?

The DCF method involves estimating future cash flows and discounting them to present value using a discount rate, typically the WACC.

How accurate is the DCF method?

The DCF method is considered highly accurate when based on reliable data and realistic assumptions. It's essential to perform sensitivity analysis to account for uncertainties.

What are common pitfalls in DCF valuation?

Common pitfalls include overestimating growth rates, underestimating risks, and using an inappropriate discount rate.

How does the DCF compare to other valuation methods?

DCF provides a detailed financial picture, unlike multiples-based methods which offer a market-comparable snapshot.

Is the DCF method applicable to all industries?

While broadly applicable, the DCF method is most effective for businesses with predictable cash flows, such as mature companies in stable industries.

What regulatory standards apply to DCF valuations in the UK?

DCF valuations should comply with guidelines from the HM Treasury and FCA, ensuring transparency and accuracy.

Business Checklist - dcf business valuation method checklist and key considerations infographic

Conclusion & Call to Action

The DCF business valuation method is an essential tool for accurately assessing business value in the UK marketplace. By following a structured approach, buyers and sellers can make informed decisions and optimize their investment outcomes. To explore more about valuations and discover opportunities, visit Arzani Marketplace today for expert guidance and resources.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv