Introduction

The process of conducting a comparable company analysis in the UK is pivotal for accurate business valuation. As of 2025, business valuations in the UK are increasingly influenced by market conditions, with demand for precise measurement methods growing. This article explores the strategic steps to effectively assess business worth using comparable company analysis, a method vital for business buyers and sellers in the UK marketplace.

Business Process Framework - Step-by-step business comparable company analysis uk process framework infographic

Table of Contents

1. Understanding Comparable Company Analysis

Comparable company analysis (CCA) involves evaluating a business by comparing it with similar companies in the same industry. This method provides insights into how the market values similar companies, offering a benchmark for fair valuation. In the UK, this approach is particularly valuable given the dynamic business environment and diverse sectors.

2. Gathering Relevant Data

Data collection is a critical step in CCA. Sources include financial statements, industry reports. Additionally, market trend documents. Utilising resources such as Companies House and the Office for National Statistics ensures accuracy and reliability of the data. Analysts should focus on revenue, EBITDA. Additionally, P/E ratios.

3. Analysing Financial Metrics

Financial metrics provide the foundation for valuation comparisons. Key metrics include the price-to-earnings ratio, enterprise value-to-sales ratio. Additionally, EBITDA multiples. These are compared against industry averages to assess a company's market standing. According to a Financial Times report, tech companies in the UK often exhibit higher multiples due to rapid growth expectations.

UK Market Statistics - UK comparable company analysis uk market statistics and data visualization

4. Adjusting for Market Conditions

Adjustments for current market conditions are necessary to ensure relevance. Factors such as economic cycles, interest rates. Additionally, sector-specific trends must be considered. The Bank of England provides insights into economic indicators that influence valuation adjustments.

5. Applying the Analysis

Once data is gathered and analysed, the next step involves applying the findings to estimate the target company’s valuation. This involves calculating an average based on comparable metrics and adjusting for unique company circumstances. The goal is to arrive at a valuation that accurately reflects market expectations and company potential.

Detailed Case Studies

Case studies illustrate the practical application of CCA in the UK market. For instance, a recent acquisition in the Leeds manufacturing sector involved a thorough CCA, resulting in a £1.8 million valuation. This case highlighted the importance of adjusting for regional economic factors and competitive landscape.

Another example from the hospitality sector in London involved a mid-sized enterprise with a valuation of £2.5 million, influenced by its robust digital presence and consistent revenue growth. These cases demonstrate the effectiveness of CCA when tailored to specific industry conditions.

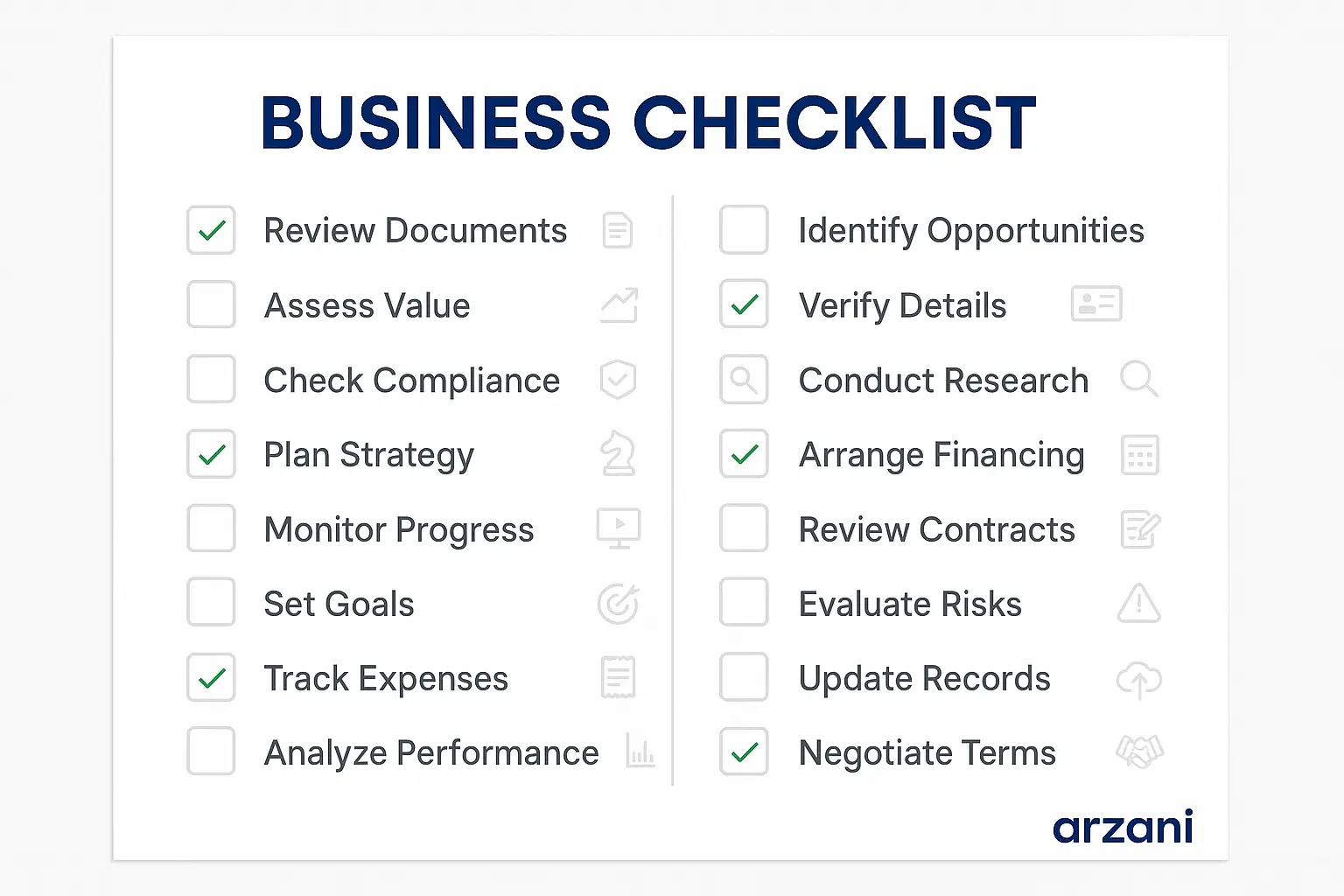

Business Timeline - Typical comparable company analysis uk timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

Typical multiples for SMEs in the UK range from 4x to 8x EBITDA, depending on industry and growth potential.

How does Brexit affect business valuations?

Brexit has introduced uncertainties, affecting valuations through changes in trade policies and market stability. Businesses with European exposure may face increased risk, influencing valuation adjustments.

Why use comparable company analysis over other methods?

CCA offers a market-based perspective, providing a clear benchmark against similar businesses. It is particularly useful in dynamic markets where intrinsic valuation methods may not capture current sentiment.

What data sources are most reliable for CCA?

Reliable data sources include Companies House for financial filings, industry reports from IBISWorld, and market trends from the ONS.

How frequently should businesses be revalued?

Businesses should consider revaluation annually or when significant changes occur in the market or the company’s operations.

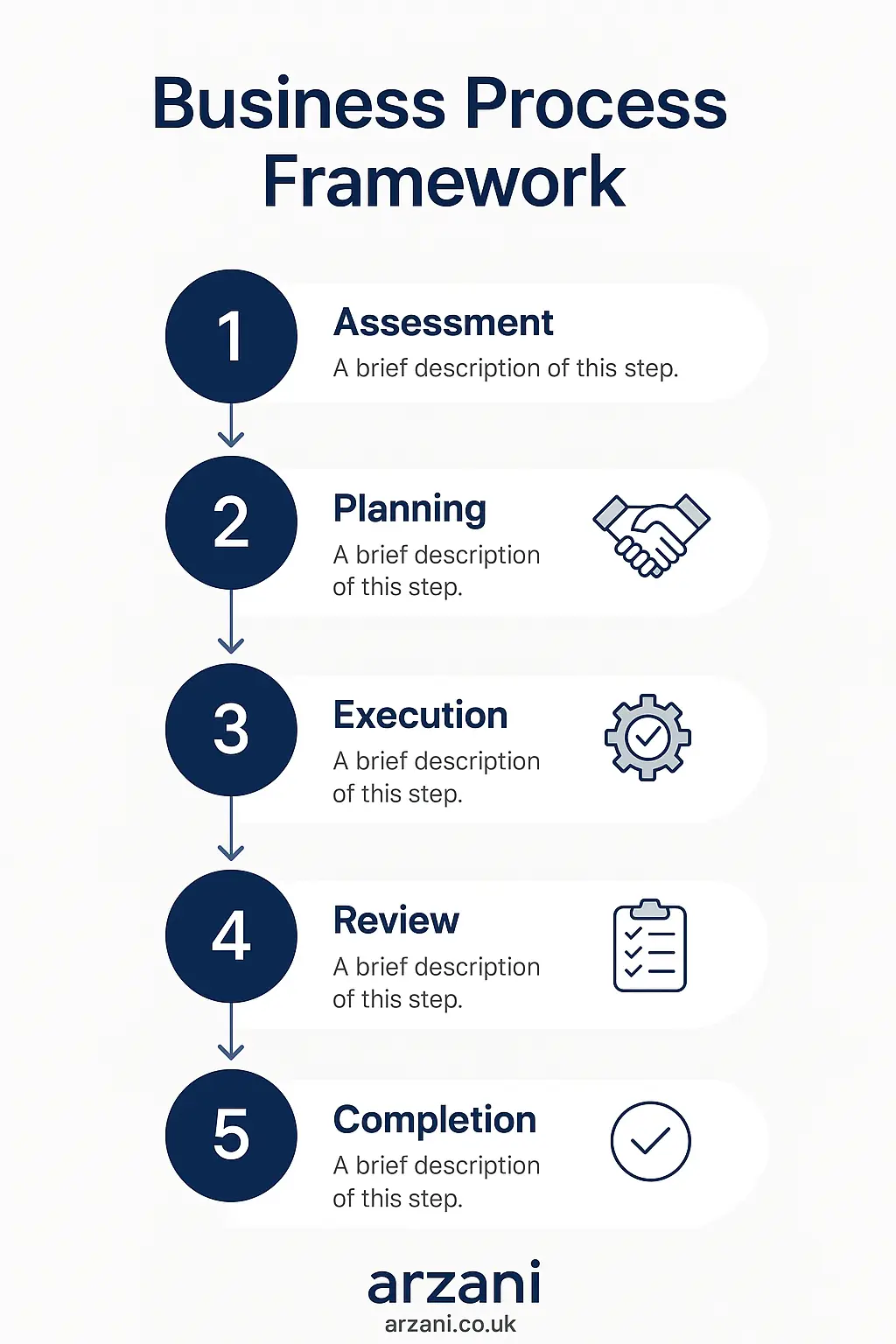

Business Checklist - comparable company analysis uk checklist and key considerations infographic

Conclusion & Call to Action

In conclusion, comparable company analysis is an essential tool for business valuation in the UK. By leveraging this method, businesses can gain a competitive edge and ensure fair pricing in transactions. For more detailed guidance and professional valuation services, visit arzani.co.uk and explore our marketplace offerings.

Whether buying or selling, understanding the value of your business is crucial. Connect with experts at Arzani to navigate the complexities of business valuation and maximise your returns.

Comparison Chart - comparable company analysis uk comparison chart and analysis infographic

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv