Introduction

The UK technology sector continues to thrive, with the market for tech business sales showing robust growth. According to a recent report by Tech Nation, the UK's digital sector expanded by over 7% in 2024, outpacing the overall economy. For entrepreneurs considering a technology business sale in the UK, understanding the nuances of the marketplace is crucial. This guide provides a comprehensive overview of the steps involved, essential considerations. Additionally, strategic insights to ensure a successful transaction.

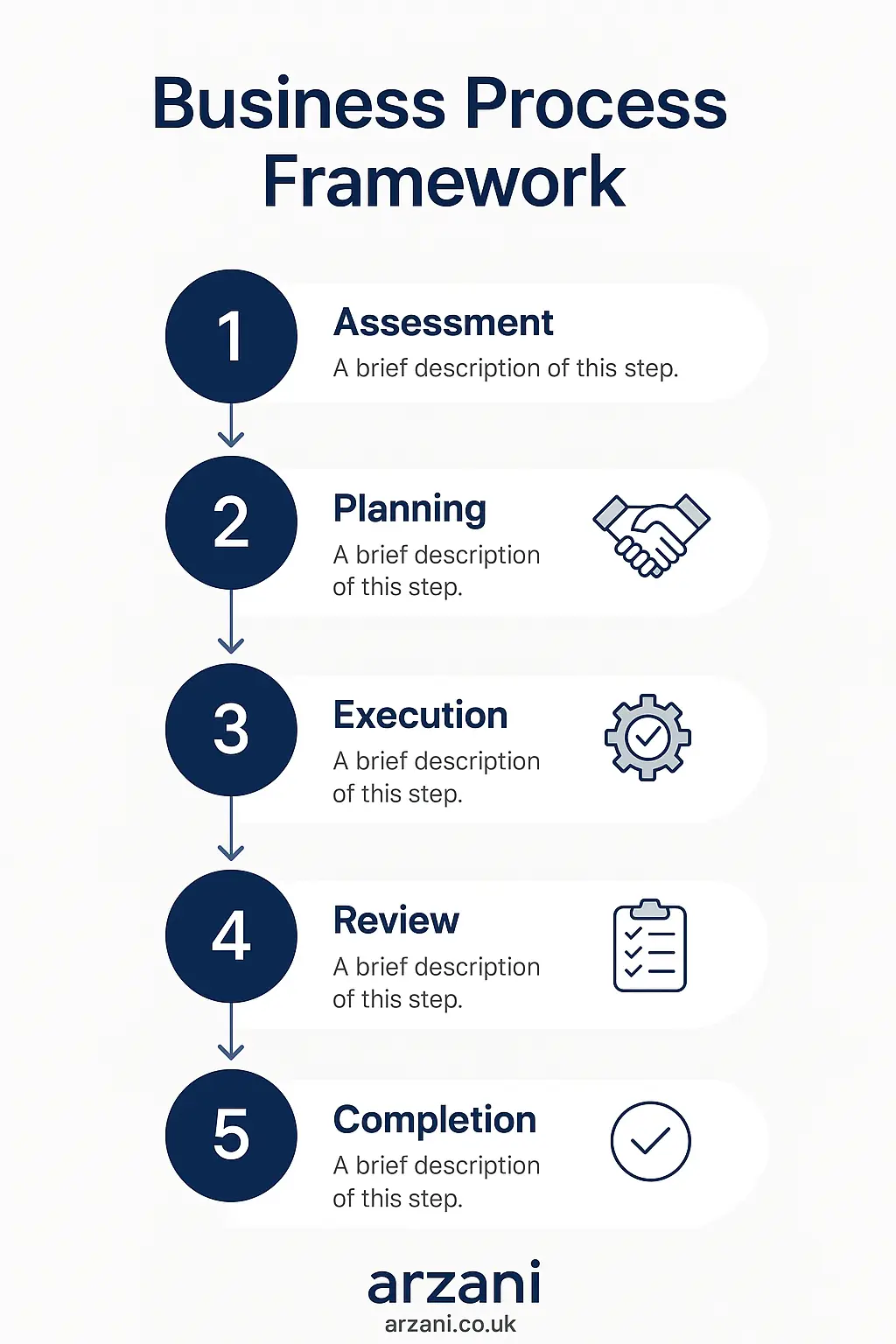

Business Process Framework - Step-by-step business technology business sale uk process framework infographic

Table of Contents

1. Understanding the Market

Entering the business sale marketplace in the UK requires a thorough understanding of current trends and valuations. According to the Office for National Statistics, the tech sector has seen a surge in valuations, with median business sale prices increasing by 12% in 2024. This indicates strong demand and a competitive landscape.

UK Market Statistics - UK technology business sale uk market statistics and data visualization

2. Preparing Your Business for Sale

Proper preparation is key to attracting potential buyers. This includes ensuring your financial records are up-to-date, optimizing operational efficiencies. Additionally, addressing any legal issues. Businesses listed on Arzani marketplace have reported higher buyer interest when these factors are meticulously managed.

3. Valuation Techniques

Determining the right price for your tech business is critical. Common valuation methods include the EBITDA multiple. This typically ranges from 4x to 6x for tech companies in the UK. Engaging a professional valuation expert can provide bespoke insights tailored to your business's unique attributes.

4. Marketing Strategies

Effective marketing can significantly impact the success of your sale. Consider leveraging both online platforms and industry networks to reach a broad audience. Listings on arzani.co.uk benefit from a targeted approach that aligns with industry-specific buyer interests.

5. Negotiating the Deal

Negotiation is a delicate process that requires a clear strategy and understanding of both parties' objectives. Successful negotiations often involve structured offers, counteroffers. Additionally, concessions, leading to a mutually beneficial agreement.

Comparison Chart - technology business sale uk comparison chart and analysis infographic

6. Legal Considerations

Compliance with UK regulations, such as those set by the FCA and Companies House, is essential. This includes ensuring all contractual documents are legally sound and meet the necessary disclosure requirements to avoid any post-sale liabilities.

7. Due Diligence Process

A thorough due diligence process is critical to uncovering potential risks and ensuring the buyer's confidence in the transaction. This involves a comprehensive review of financial statements, legal documents. Additionally, operational metrics.

Case Studies

To illustrate, consider the sale of a London-based software company in 2024. This achieved a 5.5x EBITDA multiple. This was facilitated through meticulous preparation and strategic marketing, leading to a successful acquisition by a global tech firm.

Another example involves a Manchester-based tech startup that expanded its market reach before being acquired for £2.3 million. This transaction highlights the importance of demonstrating growth potential to achieve a favourable sale price.

Business Timeline - Typical technology business sale uk timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

In 2024, the typical valuation multiple for UK SMEs in the tech sector ranged from 4x to 6x EBITDA, depending on growth potential and market conditions.

How long does it take to sell a tech business in the UK?

The timeline can vary. However, on average, a tech business sale can take 6-12 months from listing to completion, subject to due diligence and negotiation stages.

What are the key documents needed for a business sale?

Essential documents include financial statements, legal contracts, intellectual property details, and a comprehensive business overview.

How can I increase the value of my tech business before selling?

Focusing on revenue growth, operational efficiency, and establishing a strong digital presence can enhance your business's valuation.

Should I use a broker for my technology business sale?

Engaging a broker can provide professional guidance, access to a wider network of potential buyers, and help streamline the sale process.

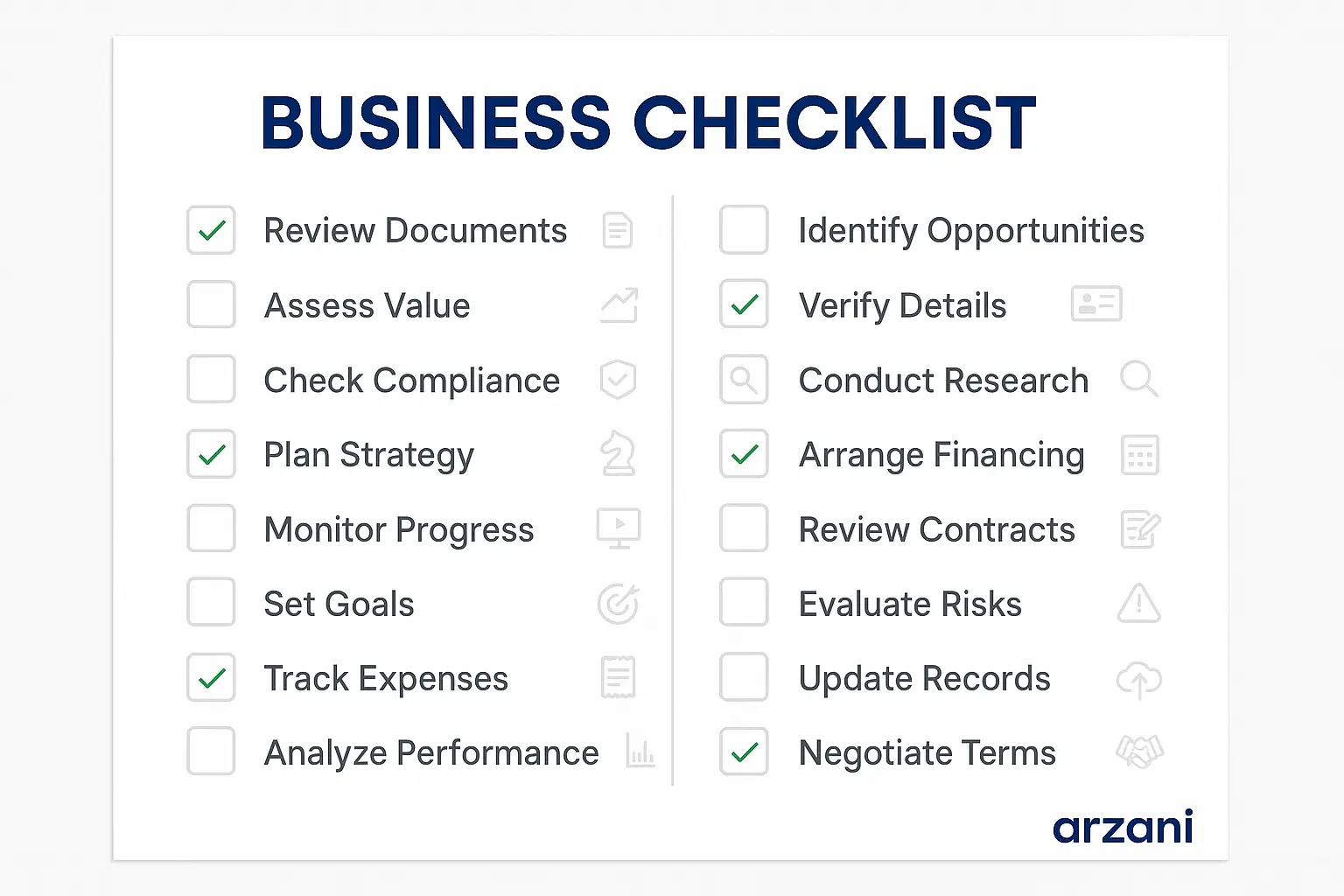

Business Checklist - technology business sale uk checklist and key considerations infographic

Conclusion & Call to Action

Selling a tech business in the UK is a complex process but can be highly rewarding with the right approach. By understanding the market, preparing adequately. Additionally, leveraging professional insights, you can maximize the potential of your sale. To explore opportunities and list your business, visit Arzani Marketplace today.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv