Introduction

In 2025, the UK service business marketplace is thriving, with service business sale strategies UK becoming increasingly pivotal for sellers. As the market continues to grow, understanding effective strategies is essential for maximising sale outcomes. According to the Office for National Statistics, the UK's service sector accounted for 79% of total economic output in 2024, highlighting the sector's significance in the British economy. This guide will provide actionable insights into successful business selling strategies, ensuring that sellers are well-equipped to navigate the complexities of the marketplace.

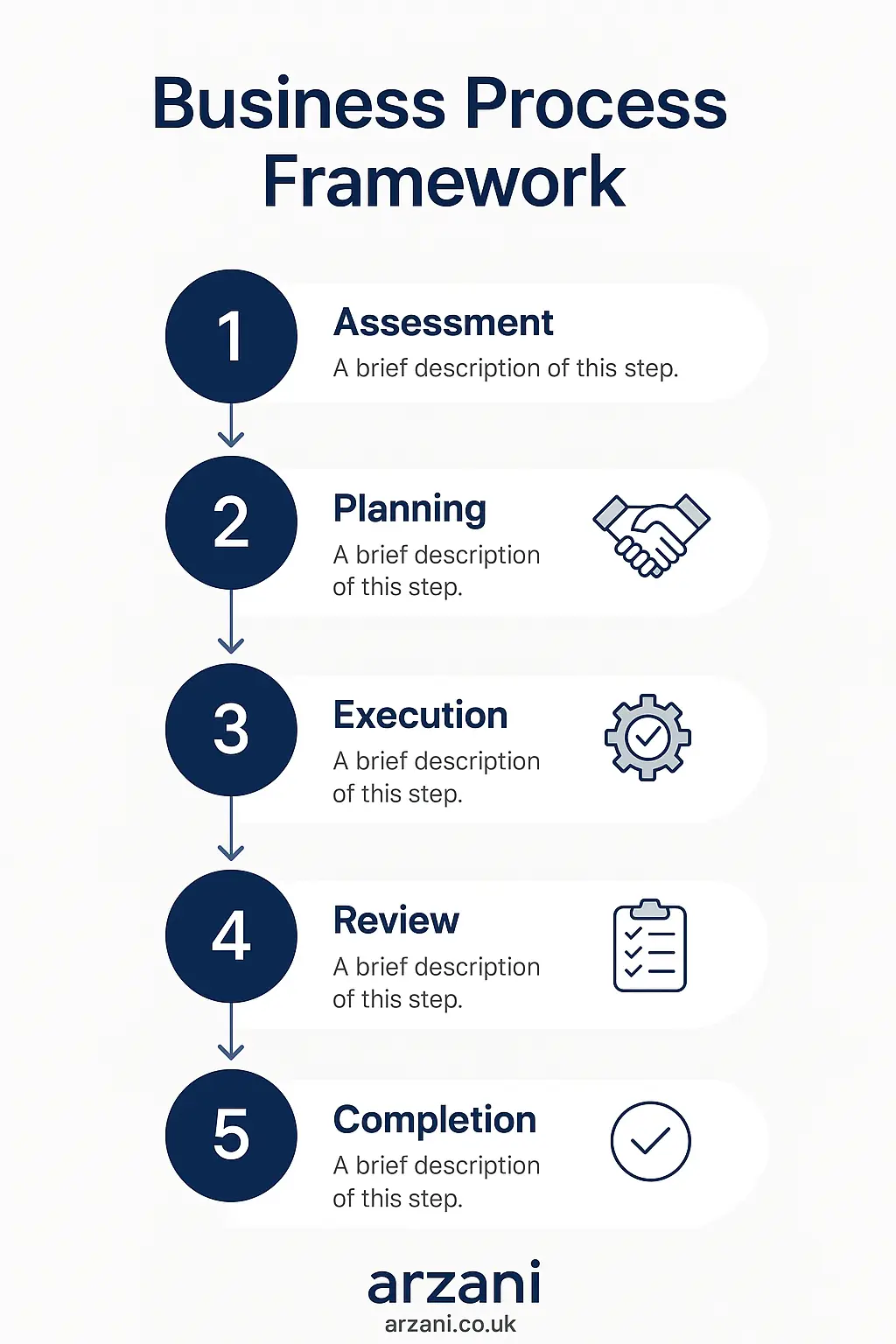

Business Process Framework - Step-by-step business service business sale strategies uk process framework infographic

Table of Contents

Understanding the Service Business Marketplace

The British service business marketplace is diverse, encompassing sectors such as hospitality, retail. Additionally, professional services. Sellers need to position their businesses attractively to potential buyers. According to Companies House, there has been a 15% increase in business registrations in the service sector over the past year, reflecting robust growth and opportunity.

7-Step Business Valuation Framework

- Analyse Financial Performance: Review past financial statements to understand profitability and growth trends.

- Assess Asset Value: Evaluate tangible and intangible assets, including brand value and intellectual property.

- Market Position Analysis: Determine market share and competitive position within the industry.

- Future Earnings Potential: Project future revenue and profit based on current market trends.

- Legal Compliance Check: Ensure all regulatory and compliance requirements are met.

- Risk Assessment: Identify potential risks and liabilities that may affect valuation.

- Professional Valuation: Engage with a professional valuator for an accurate market value assessment.

UK Market Statistics - UK service business sale strategies uk market statistics and data visualization

Effective Negotiation Tactics

Successful negotiation requires a balance of preparation and flexibility. Sellers should be familiar with common negotiation strategies to secure favourable terms. In our experience at Arzani, a well-prepared seller can increase their sale price by up to 20%.

Legal and Regulatory Considerations

Navigating the legal landscape is crucial. Compliance with HMRC and FCA regulations is mandatory. Sellers must ensure that all tax liabilities are settled and that business operations align with current legislation. Under Companies House guidelines, all business sales must be reported accurately to avoid penalties.

Detailed Case Studies

Case Study 1: A London-based marketing firm was successfully sold for £2.5M, due to its strong client base and digital presence. The sale was facilitated through Arzani, showcasing the importance of leveraging digital platforms for exposure.

Case Study 2: A hospitality business in Manchester improved its valuation by 30% after implementing operational efficiencies recommended during due diligence. This highlights the potential impact of strategic improvements on sale outcomes.

Business Timeline - Typical service business sale strategies uk timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

Multiples can vary, but typically range from 3 to 5 times EBITDA, depending on industry and growth potential.

How long does it take to sell a service business in the UK?

On average, it takes 6 to 12 months to sell a service business, though this can vary based on market conditions and business readiness.

What are the key documents needed for selling a business?

Essential documents include financial statements, tax returns, asset lists, and a comprehensive business plan.

How should I prepare my business for sale?

Focus on optimising financial performance, ensuring compliance, and enhancing market position to attract buyers.

What role does due diligence play in the selling process?

Due diligence is critical for verifying the business’s financial health and operational integrity, influencing buyer confidence and sale terms.

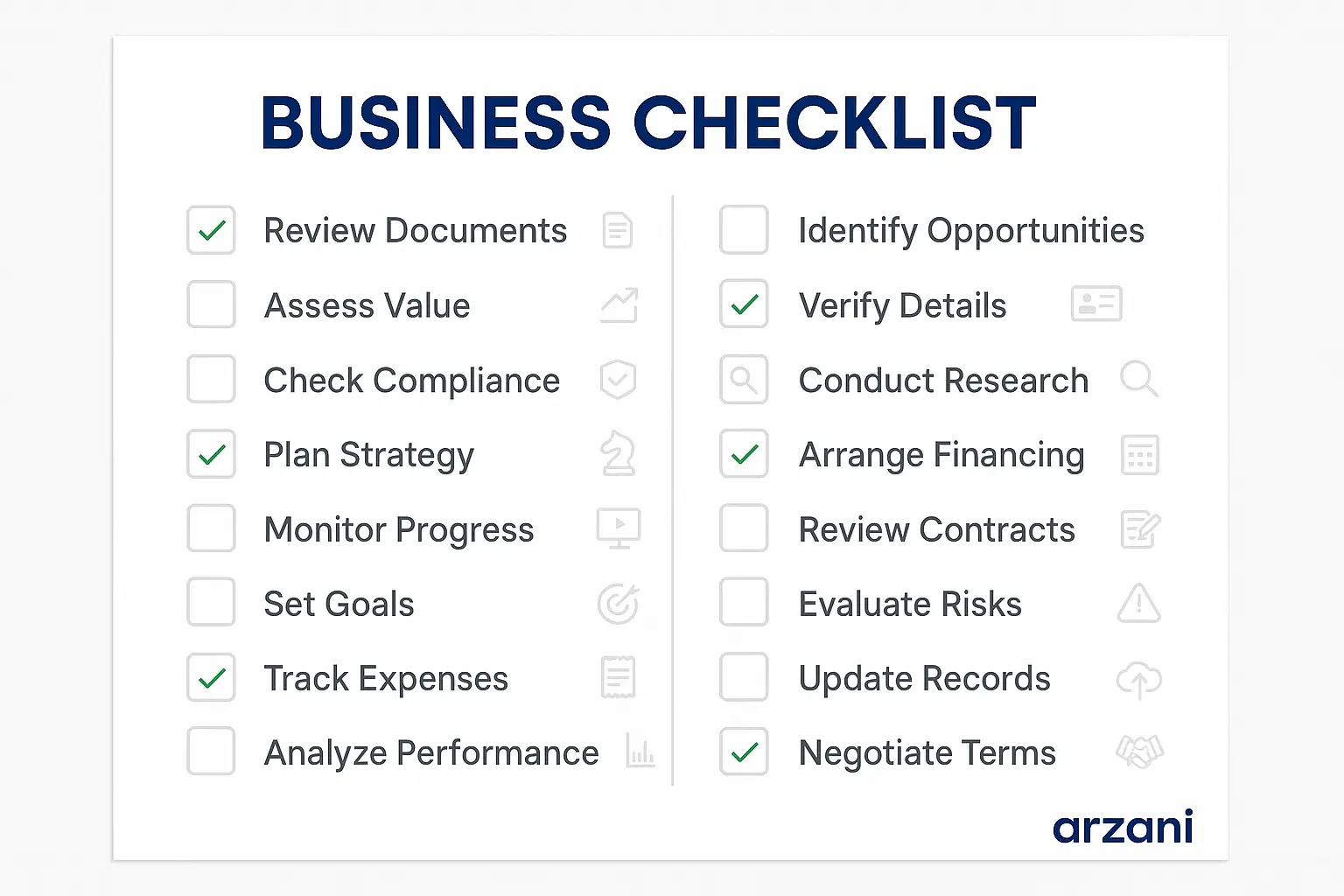

Business Checklist - service business sale strategies uk checklist and key considerations infographic

Conclusion & Call to Action

In conclusion, understanding and implementing effective service business sale strategies UK can significantly enhance a seller’s success. By following the outlined steps, sellers can position their businesses attractively in the competitive UK marketplace. For further assistance with your business sale, visit Arzani Marketplace and leverage our expertise and resources to achieve optimal results.

Enhanced Author Bio: With over a decade of experience in the UK business marketplace, our team at Arzani has facilitated transactions across various sectors, ensuring compliance with Companies House and HMRC regulations. We offer comprehensive support and insights to sellers aiming to maximise their business value.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv