Introduction

In today's dynamic UK marketplace, selling a restaurant business involves a meticulous process that can significantly influence the financial outcomes for stakeholders. As of 2025, the UK restaurant sector has seen a 12% increase in business sales, indicating a thriving market for both buyers and sellers (ONS). Understanding the restaurant business sale process is crucial for success in this competitive landscape.

business for sale uk process framework infographic"

class="responsive-infographic"

style="max-width: 100%; height: auto; border-radius: 8px; box-shadow: 0 4px 8px rgba(0,0,0,0.1);"

loading="lazy"

crossorigin="anonymous">

business for sale uk process framework infographic"

class="responsive-infographic"

style="max-width: 100%; height: auto; border-radius: 8px; box-shadow: 0 4px 8px rgba(0,0,0,0.1);"

loading="lazy"

crossorigin="anonymous">

Business Process Framework - Step-by-step business restaurant business for sale uk process framework infographic

Table of Contents

Understanding the UK Restaurant Marketplace

The UK restaurant marketplace is vibrant, with diverse opportunities for both acquisitions and sales. With a focus on authentic cuisine and innovative dining experiences, the demand for restaurant businesses has increased. According to Gov.uk, the hospitality sector contributed over £100 billion to the UK economy in 2024, showcasing its significance. Key players in this market are leveraging strategic location, brand value. Additionally, operational efficiency to enhance desirability among potential buyers.

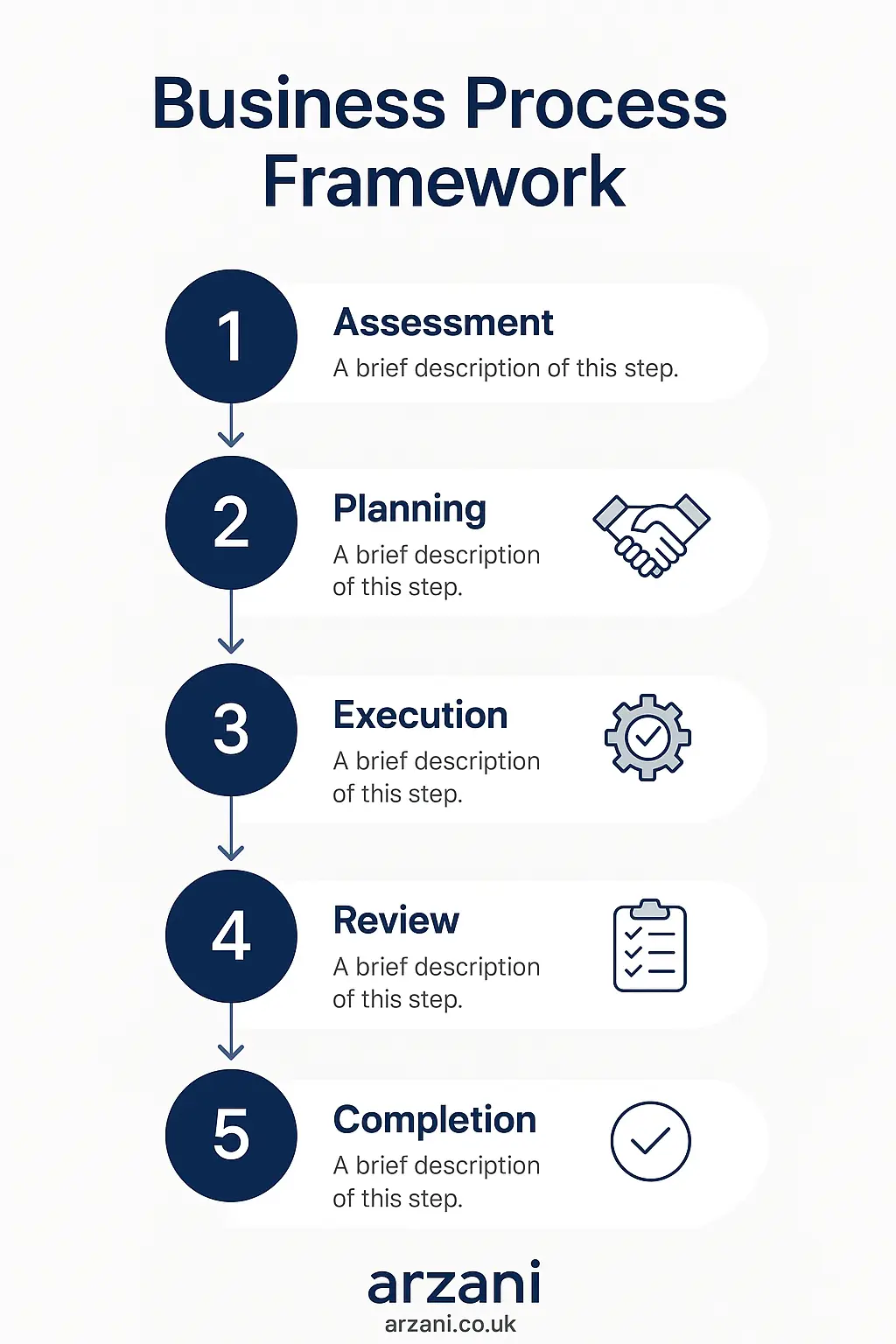

7-Step Business Valuation Framework

Accurately valuing a restaurant is imperative for setting realistic price expectations and attracting serious buyers. Here is a seven-step framework to guide you:

- Financial Performance Review: Analyse profit and loss statements, cash flow, and balance sheets.

- Asset Evaluation: Include furniture, fixtures, equipment, and inventory in the valuation.

- Market Comparison: Assess similar businesses in the area for competitive pricing.

- Location Assessment: Evaluate foot traffic, accessibility, and demographics.

- Brand Equity: Consider brand reputation and customer loyalty.

- Operational Efficiency: Examine staffing, supply chain, and processes.

- Growth Potential: Identify expansion opportunities or new market segments.

These steps align with industry standards and ensure a comprehensive valuation (FCA guidance).

UK Market Statistics - UK restaurant business for sale uk market statistics and data visualization

Legal Considerations and Compliance

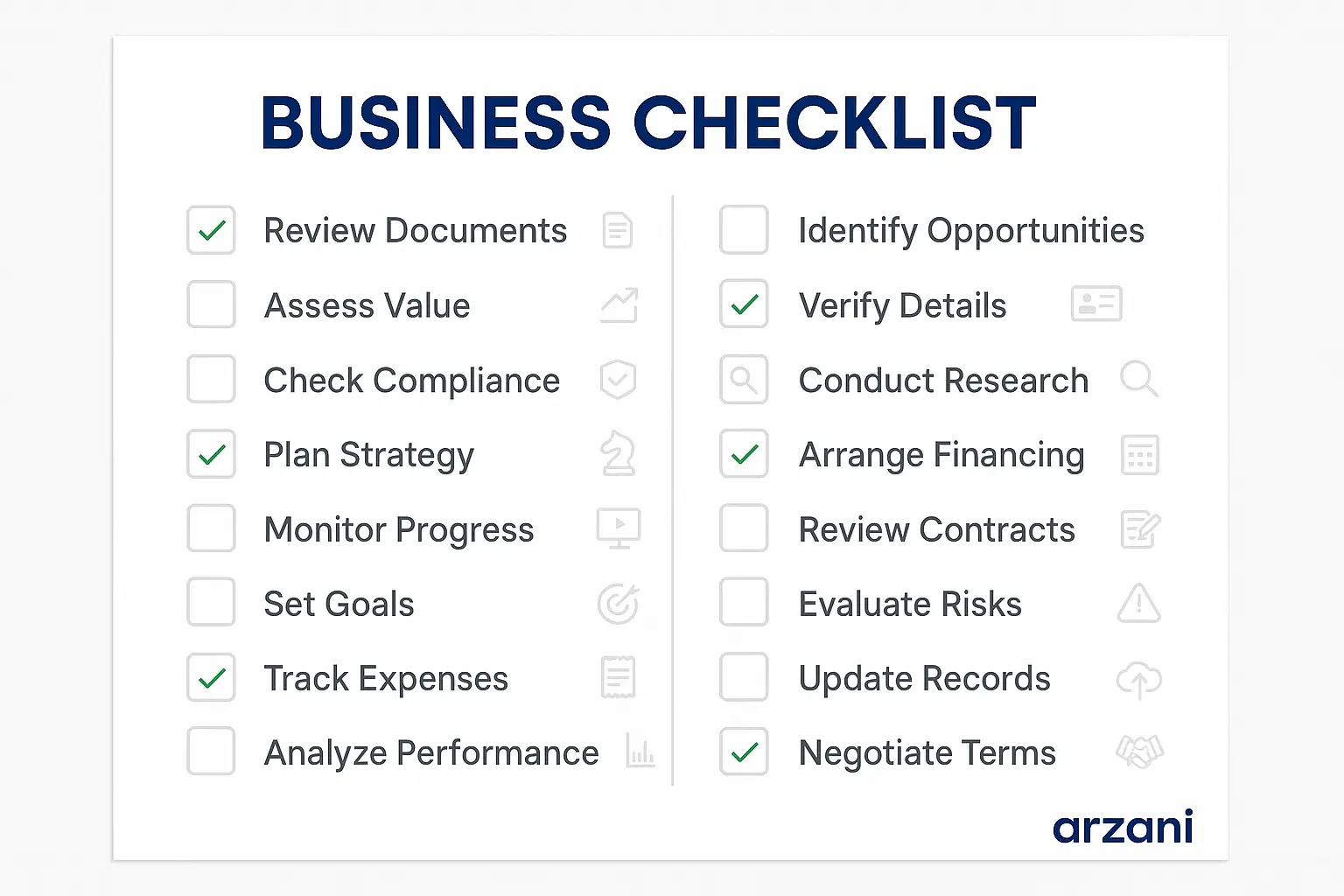

Compliance with UK regulations is vital when selling a restaurant business. Key legal considerations include:

- Transfer of Premises Licence: Ensure the new owner can legally operate.

- Employee Transfer: Comply with TUPE regulations to protect worker rights.

- Lease Agreement: Review terms and obtain landlord consent for transfer.

- HMRC Obligations: Settle any outstanding tax liabilities and update VAT registrations.

Consulting with a legal expert is advisable to navigate these complexities and ensure compliance with Companies House requirements.

Marketing Your Restaurant Business

Effective marketing strategies are critical to attract potential buyers. Utilize the following approaches:

- Professional Listings: Use platforms like Arzani Marketplace to reach a broad audience.

- Confidential Information Memorandum (CIM): Prepare a detailed document highlighting business strengths.

- Digital Marketing: Leverage social media and online advertising for targeted outreach.

- Network Engagement: Connect with industry contacts and business brokers.

These strategies, combined with a well-presented CIM, can significantly enhance buyer interest.

Negotiation and Sale Execution

Successful negotiations and sale execution require professionalism and strategic planning:

- Initial Discussions: Establish rapport and understand buyer motivations.

- Offer and Counteroffer: Be prepared to negotiate terms and price.

- Due Diligence: Facilitate thorough buyer inspections and document reviews.

- Final Agreement: Draft a comprehensive sale agreement covering all terms.

- Closing the Deal: Complete legal formalities and transfer ownership.

These steps are crucial for a smooth transition and are supported by professional advice from legal and financial advisors.

Case Studies

Let's explore some real-world examples of successful restaurant business sales:

Case Study 1: The London Bistro

A popular bistro in London was sold for £750,000 in 2024. The sale was facilitated by highlighting its prime location and established clientele. The negotiation process involved a strategic price adjustment that satisfied both parties.

Case Study 2: The Northern Café

A café in Manchester was acquired for £450,000. The buyer was attracted by the café's strong local brand and potential for franchising. Comprehensive due diligence ensured a transparent transaction process.

Business Timeline - Typical restaurant business for sale uk timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

Multiples can vary significantly but typically range from 3x to 5x EBITDA, depending on the sector and business performance.

How long does it take to sell a restaurant in the UK?

The timeline can range from 6 months to over a year, influenced by market conditions and buyer interest.

What documents are needed for the sale?

Essential documents include financial statements, legal contracts, inventory lists, and employee records.

How can I increase the value of my restaurant before sale?

Improving financial performance, enhancing curb appeal, and expanding the customer base can boost valuation.

Should I hire a broker to sell my restaurant?

While not mandatory, brokers can provide valuable market insights and access to a network of potential buyers.

Business Checklist - restaurant business for sale uk checklist and key considerations infographic

Conclusion & Call to Action

In conclusion, selling a restaurant business in the UK requires a strategic approach, from valuation to negotiation. By leveraging professional insights and adhering to legal requirements, sellers can maximise their returns. To explore more opportunities or list your restaurant, visit Arzani Marketplace, where you can connect with potential buyers and access expert guidance.

Ready to take the next step? Contact our team for personalised support and start your journey towards a successful sale today!

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv