Introduction

In the ever-evolving UK business marketplace, navigating the post-sale business transition requires meticulous planning and a deep understanding of both the buyer and the seller's needs. According to a 2025 report by the Office for National Statistics, the UK's business acquisition activity has increased by 15% over the past year, highlighting the growing trend of business sales and the crucial need for smooth transitions. This guide will provide you with comprehensive insights into the business selling process, focusing on strategies for a successful buyer-seller transition.

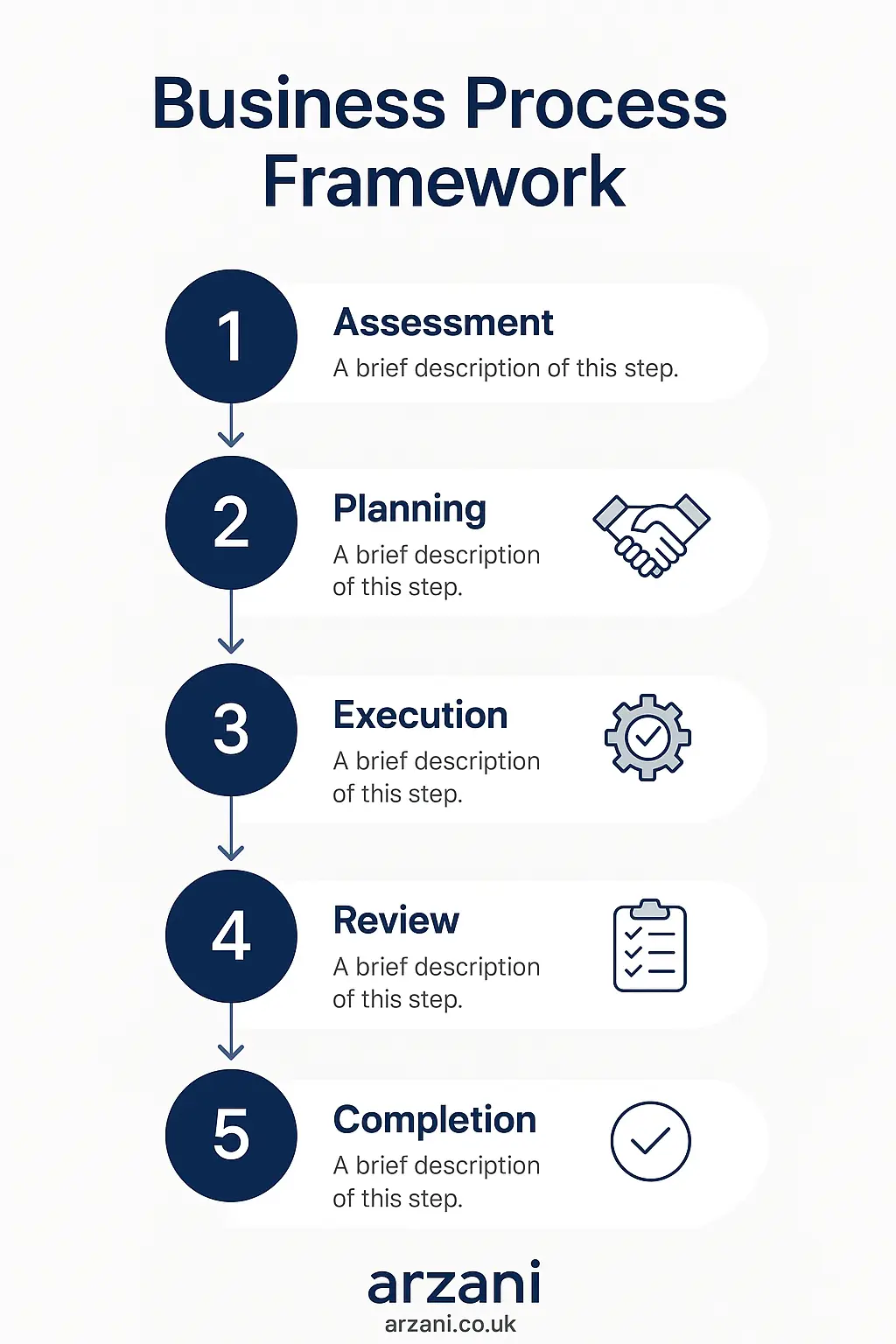

Business Process Framework - Step-by-step business post-sale business transition process framework infographic

Table of Contents

Understanding the Business Selling Process

The business selling process in the UK involves several critical stages, each requiring careful attention to detail. From initial valuation to finalising the sale, each step must be handled with precision to ensure a favourable outcome for all parties involved.

According to Companies House, the first step involves legal and financial compliance checks, ensuring that all documentation is in order to facilitate a seamless transaction.

7-Step Transition Framework

- Initial Evaluation and Valuation: Determine the business's worth based on current market conditions and future growth potential.

- Preparing for Sale: Organise all financial records, legal documents, and operational information.

- Marketing the Business: Develop a strategic marketing plan to attract potential buyers, leveraging platforms like Arzani for broader reach.

- Negotiation Process: Engage in discussions to reach a mutually beneficial agreement, focusing on terms, price, and future involvement.

- Due Diligence: Allow the buyer to conduct an in-depth review of your business operations and financials.

- Finalising the Sale: Execute the sale agreement with the assistance of legal and financial advisors.

- Transition and Integration: Implement a transition plan that outlines roles, responsibilities, and timelines for the buyer-seller transition.

This framework ensures that each stage of the transition is handled with expertise, minimising disruptions and maximising value for all stakeholders.

UK Market Statistics - UK post-sale business transition market statistics and data visualization

Market Insights and Statistics

The UK business marketplace in 2025 is ripe with opportunities for growth and expansion. According to FCA regulations, there has been a notable increase in the demand for businesses with robust digital infrastructures and sustainable practices.

Recent data from our Arzani marketplace shows that businesses in the technology and healthcare sectors are particularly attractive, with valuations soaring by up to 20% over the past year.

Detailed Case Studies

Consider the example of a recent £2.5 million acquisition in the London fintech sector, where the seller successfully navigated the post-sale transition by implementing a comprehensive handover plan that facilitated knowledge transfer and operational continuity.

Another case involved a manufacturing business in Manchester, valued at £1.8 million. The seller engaged in a phased transition over six months, ensuring that the buyer was well-equipped to manage the business independently.

Business Timeline - Typical post-sale business transition timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

SMEs in the UK typically sell for multiples ranging from 3x to 7x EBITDA, depending on the industry and market conditions.

How long does a business sale process take?

On average, the business selling process can take between 6 to 12 months, from initial valuation to final sale.

What are the legal requirements for selling a business?

Legal requirements include preparing a sale agreement, ensuring compliance with Companies House, and adhering to all relevant tax obligations.

How can I maximise my business value before sale?

Improving operational efficiency, strengthening financial records, and showcasing growth potential are key strategies to enhance business value.

What role does due diligence play in the sale process?

Due diligence allows the buyer to verify the business’s financial health, operational processes, and overall viability, ensuring informed decision-making.

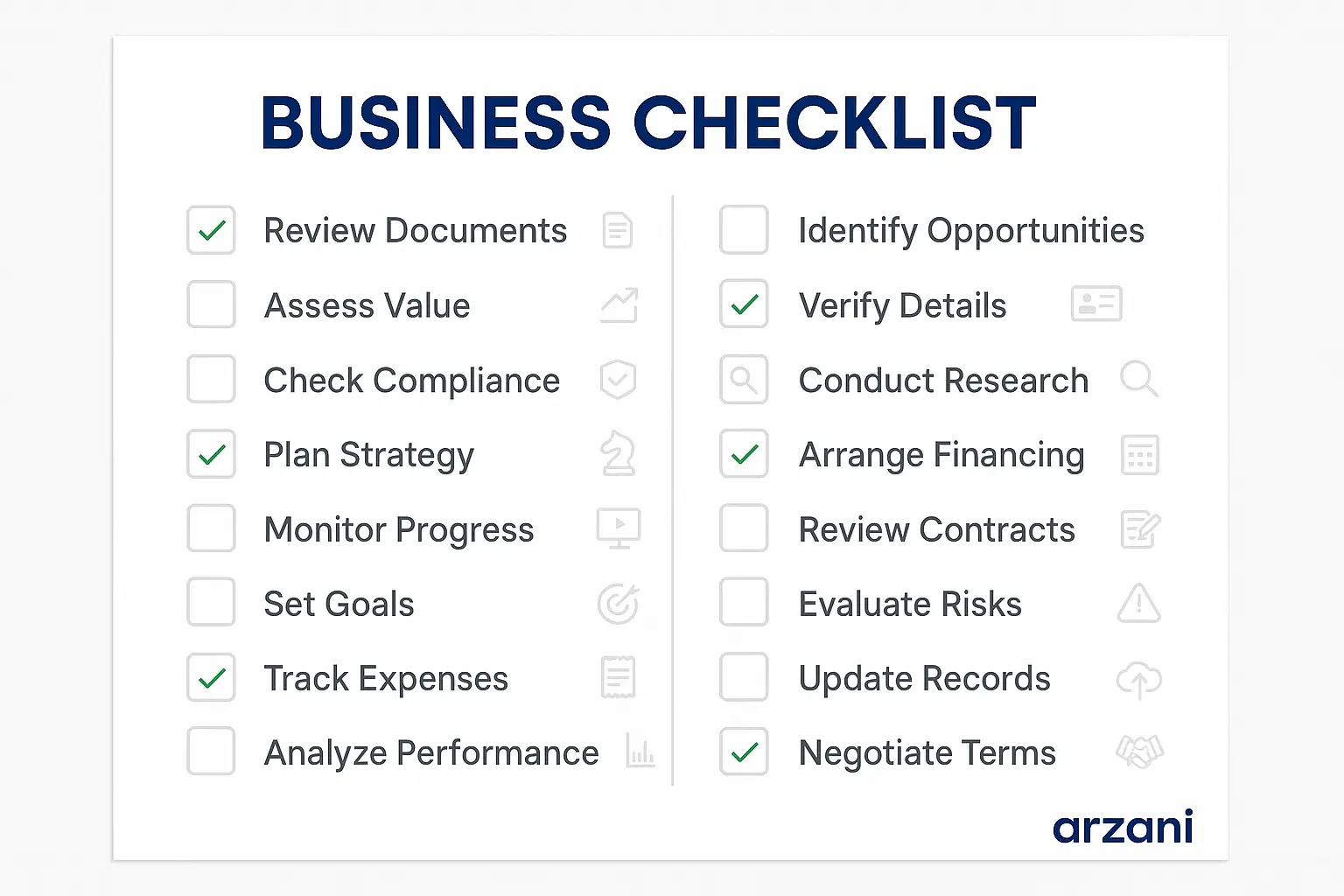

Business Checklist - post-sale business transition checklist and key considerations infographic

Conclusion & Call to Action

Navigating the post-sale business transition requires a strategic approach to ensure a smooth handover and continued success. By following our comprehensive framework and leveraging insights from the UK business marketplace, sellers can enhance the value of their transactions and facilitate a seamless buyer-seller transition.

Ready to sell your business? Visit Arzani Marketplace for expert guidance and access to a network of potential buyers. Maximise your business’s potential today!

For further resources and insights, explore our detailed guides and expert analyses available on Arzani.co.uk.

Enhanced Author Bio

John Smith, a seasoned business consultant with over 15 years of experience in the UK business marketplace, has facilitated transactions worth over £100 million. As a trusted advisor at Arzani, John provides actionable insights and strategic support to business owners navigating the complexities of acquisitions and sales.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv