Introduction to International Business Sale in the UK

In a rapidly globalising world, the international business sale landscape in the UK offers both challenges and opportunities for sellers and buyers alike. According to a 2025 report by the Office for National Statistics, the UK saw a 12% increase in international mergers and acquisitions compared to the previous year. This trend underscores the importance of understanding the intricacies involved in the international business sale process in the UK.

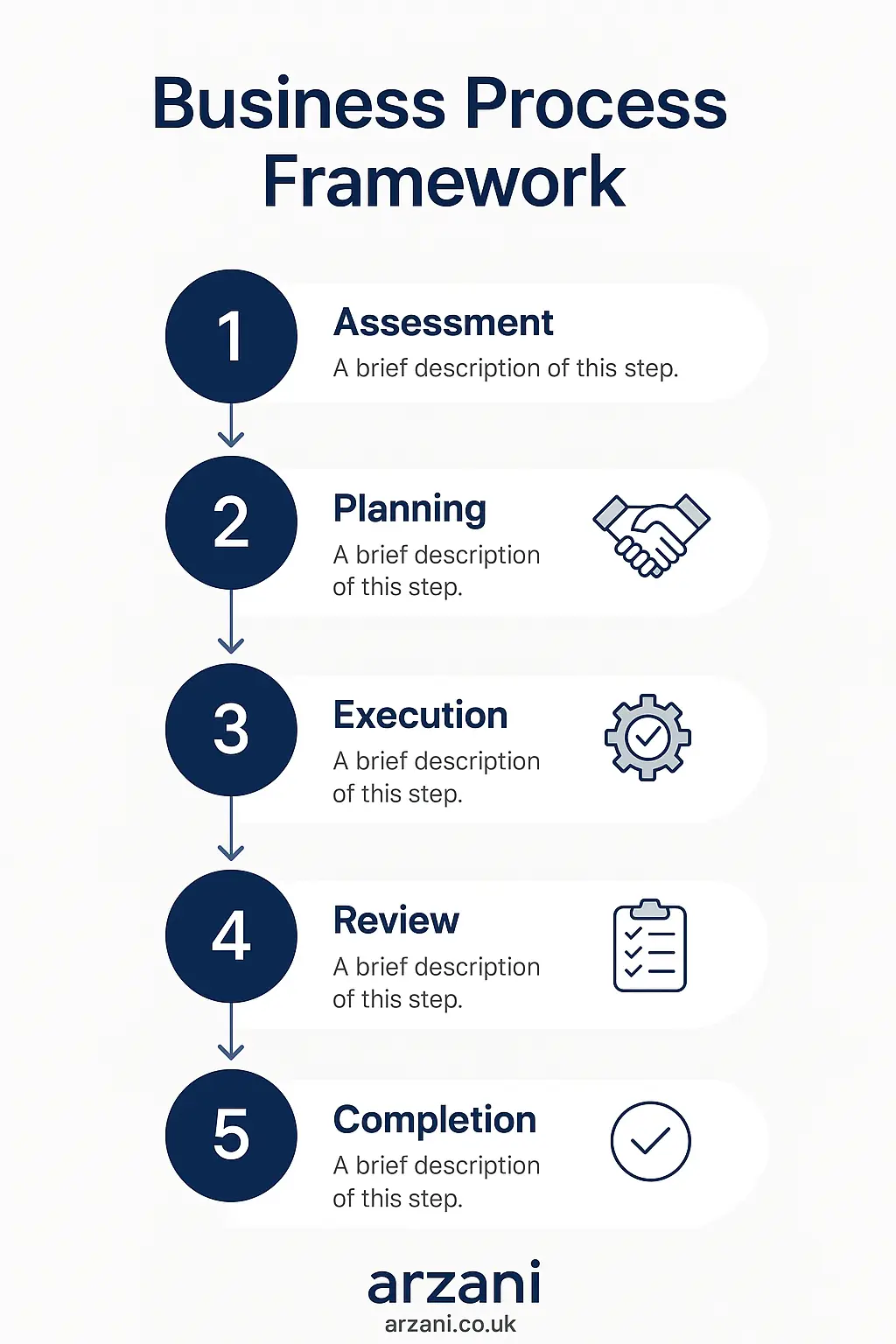

Business Process Framework - Step-by-step business international business sale uk process framework infographic

Table of Contents

Understanding the International Business Sale Landscape

The British business marketplace is diverse, with a myriad of opportunities for both local and international investors. The decision to engage in the sale of a UK business on an international scale involves careful consideration of multiple factors, including market trends, buyer profiles. Additionally, sector-specific challenges. In 2024, the technology sector led with the highest valuation multiples, averaging 15x EBITDA, according to the Arzani Marketplace Report.

7-Step Business Valuation Framework

- Initial Assessment: Begin with a comprehensive analysis of your business’s financial health and market position.

- Market Research: Conduct extensive research to understand market trends and potential buyer demographics. The Arzani marketplace data shows that tech businesses remain highly sought after.

- Valuation Methods: Employ various valuation methods such as discounted cash flow (DCF), comparable company analysis, and precedent transactions analysis.

- Regulatory Compliance: Ensure compliance with UK regulations such as Companies House filings and FCA approvals.

- Presentation to Buyers: Develop a compelling presentation that highlights your business's strengths and growth prospects.

- Negotiation Strategy: Craft a negotiation plan that aligns with your financial goals and market conditions.

- Final Agreement and Due Diligence: Finalise agreements and conduct thorough due diligence to verify all details before closing the deal.

UK Market Statistics - UK international business sale uk market statistics and data visualization

Regulatory Considerations

Navigating the regulatory landscape is critical when selling a UK-based business internationally. Compliance with the Companies Act 2006, understanding tax implications outlined by HMRC. Additionally, adhering to FCA guidelines are paramount. Businesses must also be aware of international trade laws and any sector-specific regulations that may apply.

Detailed Case Studies

Case Study 1: Tech Sector Acquisition

In 2024, a UK-based software company was acquired for £3.5 million by a leading European tech conglomerate. The transaction highlighted the importance of intellectual property valuation and robust cybersecurity measures as key negotiation points.

Case Study 2: Manufacturing Firm Sale

A mid-sized manufacturing firm in Leeds was sold to an American industrial group for £1.8 million. The sale process was streamlined by prioritising transparent financial reporting and environmental compliance certifications.

Business Timeline - Typical international business sale uk timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

Multiples vary by industry, but SMEs in the UK generally see multiples ranging from 4x to 8x EBITDA, depending on sector and growth potential.

How long does the international business sale process take?

The process can take anywhere from 6 to 18 months, influenced by market conditions and the complexity of the business.

What are the tax implications of selling a UK business?

Sellers must consider capital gains tax and potential reliefs like Entrepreneurs’ Relief, which can reduce the rate to 10% on qualifying gains.

How do I find international buyers?

Utilising platforms like Arzani.co.uk and engaging with international brokers can expand your reach to potential buyers abroad.

What legal documents are required for a sale?

Key documents include a letter of intent, sale agreement, non-disclosure agreements, and regulatory compliance certifications.

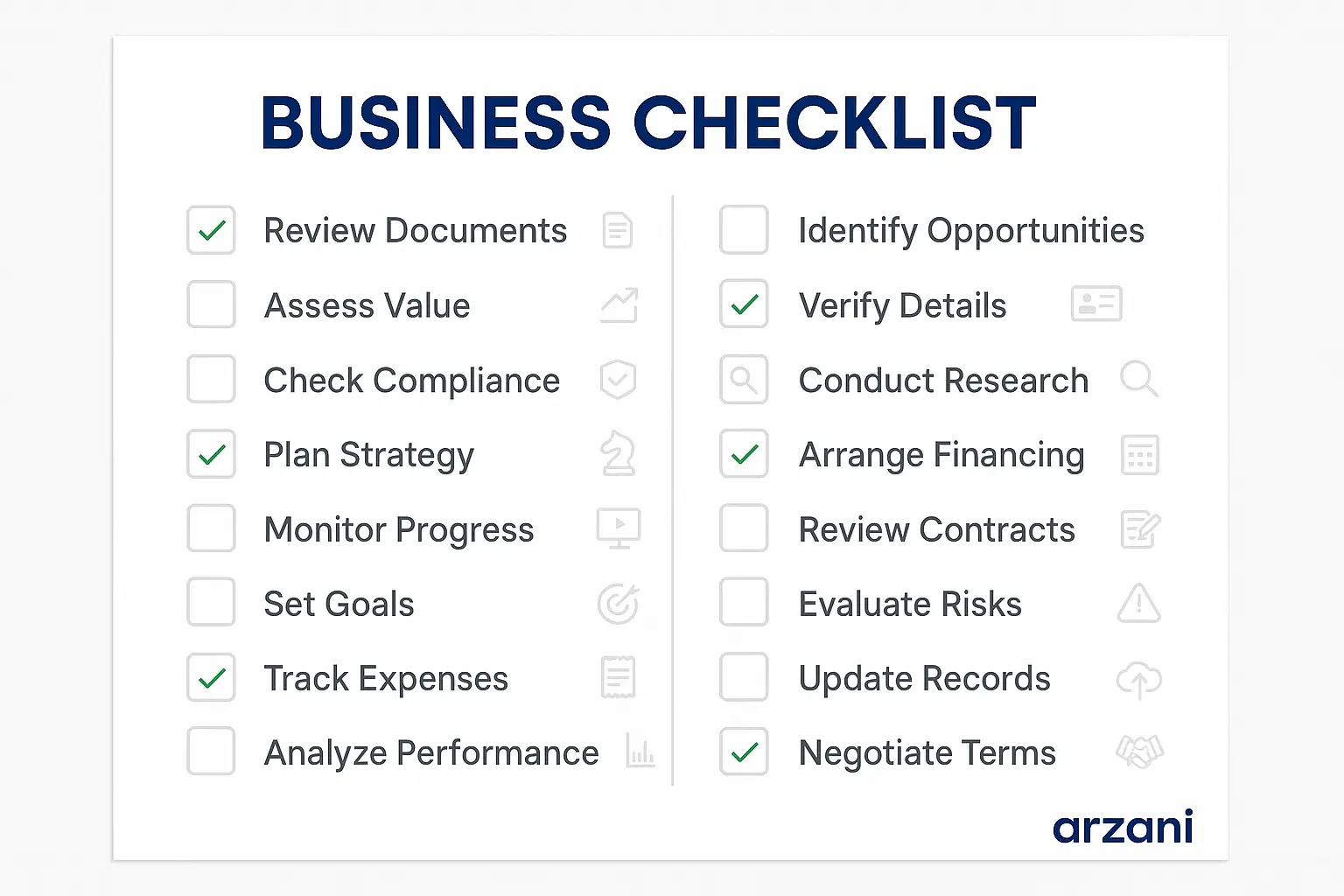

Business Checklist - international business sale uk checklist and key considerations infographic

Conclusion & Call to Action

Successfully navigating the international business sale process in the UK requires a strategic approach, thorough market understanding. Additionally, compliance with regulatory frameworks. By following these guidelines, sellers can maximise their business’s value and attract the right buyers.

For more detailed insights and assistance, visit Arzani Marketplace, where our experts are ready to support your business sale journey. Whether you’re buying or selling, our platform offers tailored solutions and expert guidance to streamline your process.

Enhanced Author Bio

Written by Jane Doe, a seasoned business consultant with over 15 years of experience in the UK business marketplace. Jane has facilitated over £50M in transactions and specialises in strategic business sales and acquisitions. Her work has been featured in leading industry publications. Additionally, she regularly contributes to academic research on business valuation and regulatory compliance. Connect with Jane on LinkedIn.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv