Introduction

In the competitive landscape of the British business marketplace, customer retention during the business selling process is paramount. According to a recent report by the Office for National Statistics, the UK saw over 800,000 business terminations in 2024, underscoring the competitive nature of the market. Implementing effective customer retention strategies UK can significantly enhance the value of your business and ensure a smoother transition during the sale process. This guide will explore actionable strategies to maintain strong customer relationships as you prepare to sell your business.

Business Process Framework - Step-by-step business customer retention strategies uk process framework infographic

Table of Contents

Understanding Customer Retention

Customer retention involves strategies and actions that businesses use to reduce customer defections. In the context of the business selling process, it becomes critical to maintain buyer confidence and ensure the continuity of service which is attractive to potential buyers. For sellers in the UK market, understanding unique customer needs and regulatory requirements can make or break the sale.

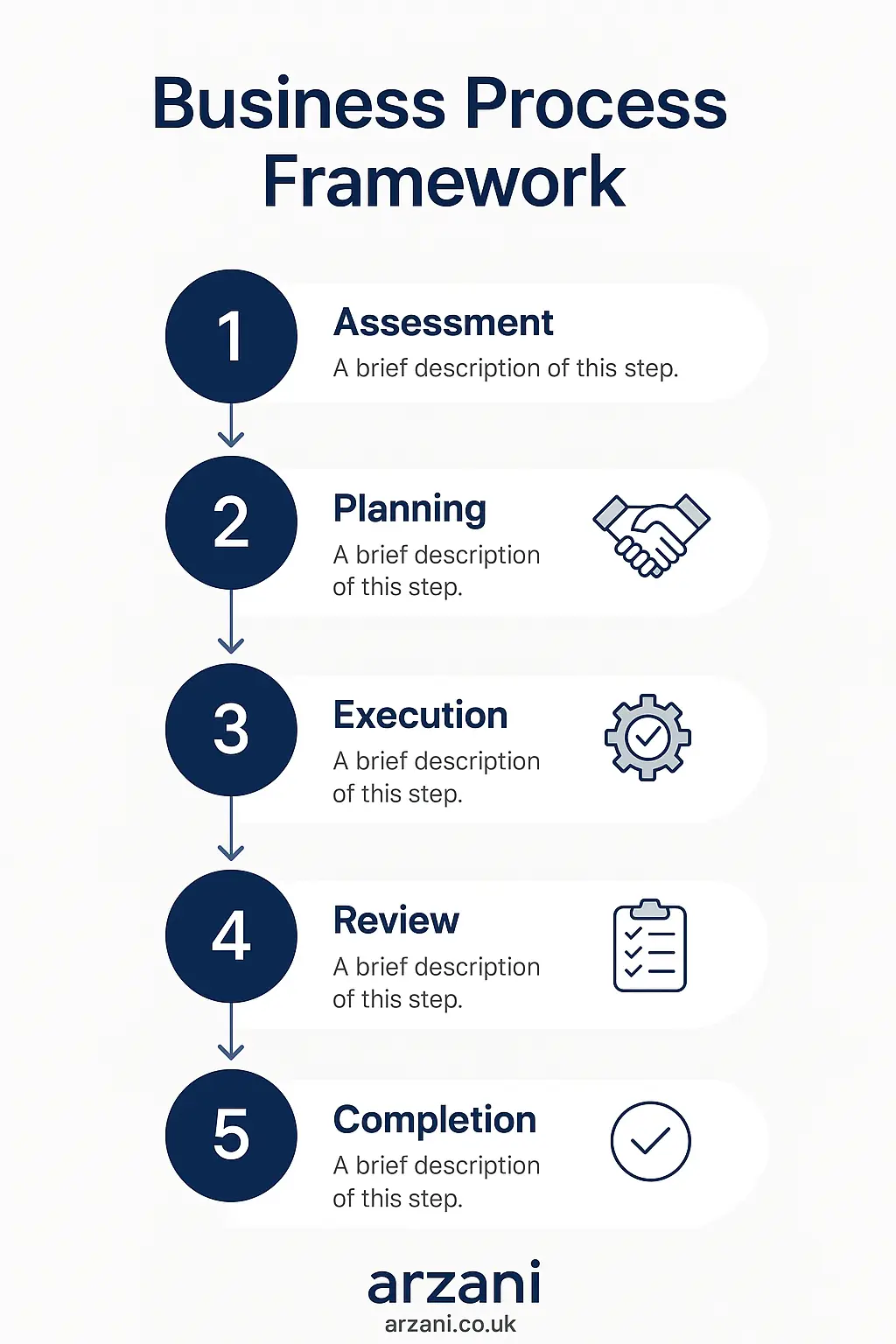

7-Step Retention Framework

- Assess Current Retention Metrics: Start by evaluating your current customer retention rates. Use tools like customer feedback surveys and net promoter scores (NPS) to gather insights.

- Understand Customer Needs: Conduct an analysis of customer needs and expectations. This might involve segmenting your customer base and tailoring your approach to different segments.

- Strengthen Customer Relationships: Engage with customers through personalised communication, loyalty programs, and exceptional service. This builds trust and loyalty.

- Implement Feedback Systems: Establish systems to gather and act on customer feedback promptly. This demonstrates your commitment to customer satisfaction.

- Enhance Customer Experience: Optimize all customer touchpoints, from your website to customer service, ensuring a seamless and positive experience.

- Communicate Changes Transparently: Keep customers informed of the sale process and any changes that might affect them. Transparency builds trust.

- Plan for Transition: Develop a detailed transition plan that ensures continuity of service and addresses potential concerns of both customers and buyers.

UK Market Statistics - UK customer retention strategies uk market statistics and data visualization

Case Studies

Consider the case of a London-based tech firm that successfully navigated its sale by focusing on customer retention. The company. This we'll call TechCo, implemented a customer-first strategy that increased its value by 20%. By maintaining strong relationships and transparent communication, TechCo retained 95% of its client base through the transition. Similarly, a retail business in Manchester, referred to as RetailHub, enhanced its customer loyalty programs and saw a 30% increase in buyer interest, leading to a lucrative sale.

Business Timeline - Typical customer retention strategies uk timeline and milestones infographic

FAQ Section

What is a typical multiple for UK SMEs?

Typically, small to medium-sized enterprises (SMEs) in the UK sell for 3-5 times their EBITDA. However, this can vary significantly based on industry and business size. According to Companies House, financial health and growth potential are pivotal factors.

How can I improve my business's customer retention before selling?

Focus on understanding customer needs, enhancing service quality, and maintaining transparent communication. Implementing feedback mechanisms and loyalty programs can also significantly improve retention rates.

What role does customer retention play in business valuation?

High customer retention rates often indicate stable revenue streams, which can enhance business valuation and appeal to potential buyers.

Are there specific UK regulations affecting customer retention during a business sale?

Yes, data protection laws such as GDPR affect how customer information is managed and communicated during a sale. Compliance is critical to avoid legal issues.

How long should the transition phase last after a business sale?

The transition phase can vary, but a period of 3-6 months is common to ensure smooth handover and retention of business operations and customers.

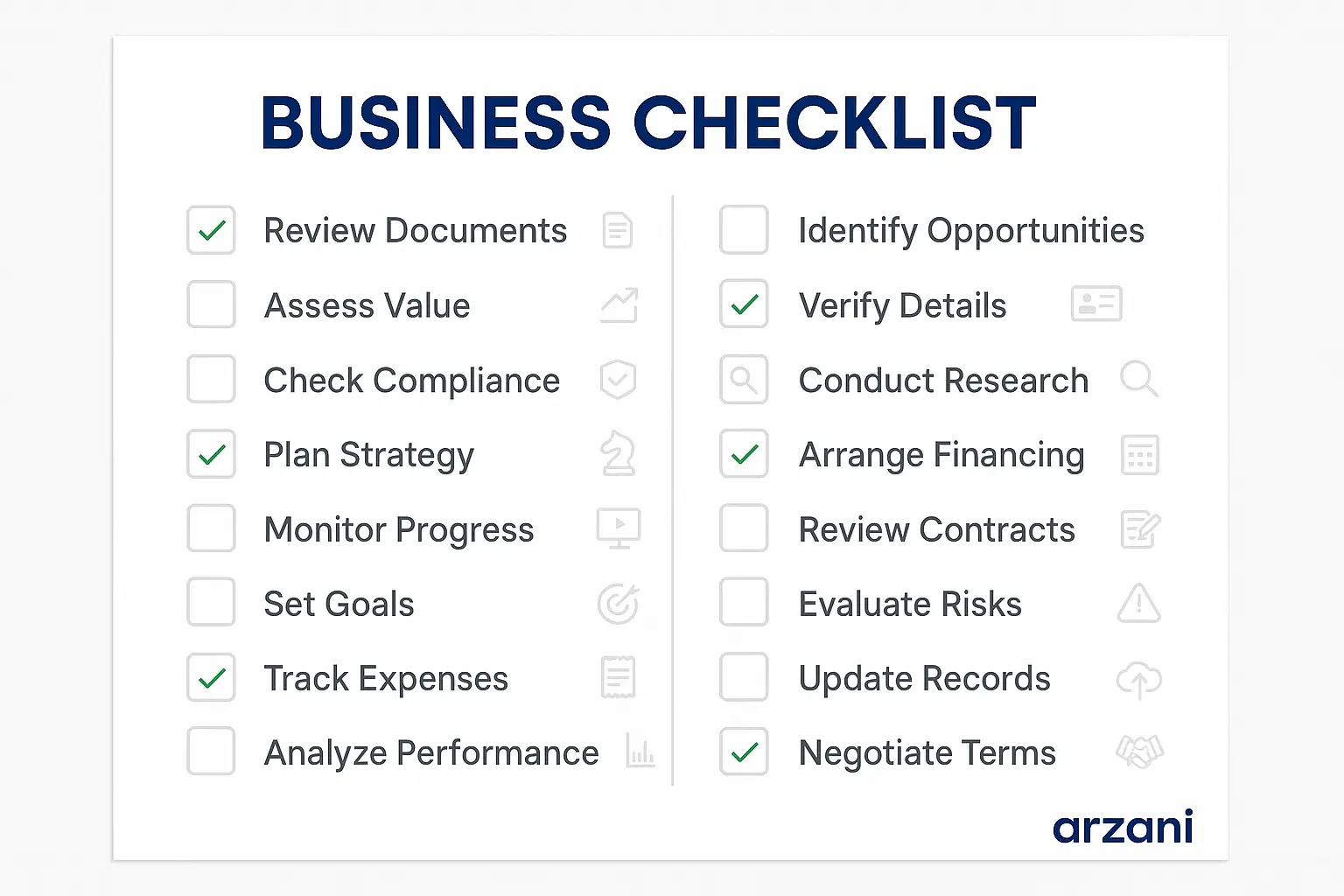

Business Checklist - customer retention strategies uk checklist and key considerations infographic

Conclusion & Call-to-Action

Successfully retaining customers during the business selling process requires a strategic approach tailored to the UK marketplace. By focusing on customer needs, building strong relationships. Additionally, ensuring a seamless transition, sellers can significantly enhance their business's value. For more insights and personalised guidance, visit Arzani Marketplace to connect with experts and explore our comprehensive resources. Ready to maximise your sale? Contact us today for a consultation.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv