Introduction

In the dynamic landscape of UK business sales, understanding the intricacies of business sale warranty and indemnity is imperative for both buyers and sellers. With the UK market witnessing a 15% increase in business sales in 2025, the role of warranties and indemnities has become more prominent than ever. These instruments are critical for safeguarding interests and mitigating risks in transactions. This article provides a comprehensive guide to navigate these complex terms, ensuring smoother negotiations and successful deals.

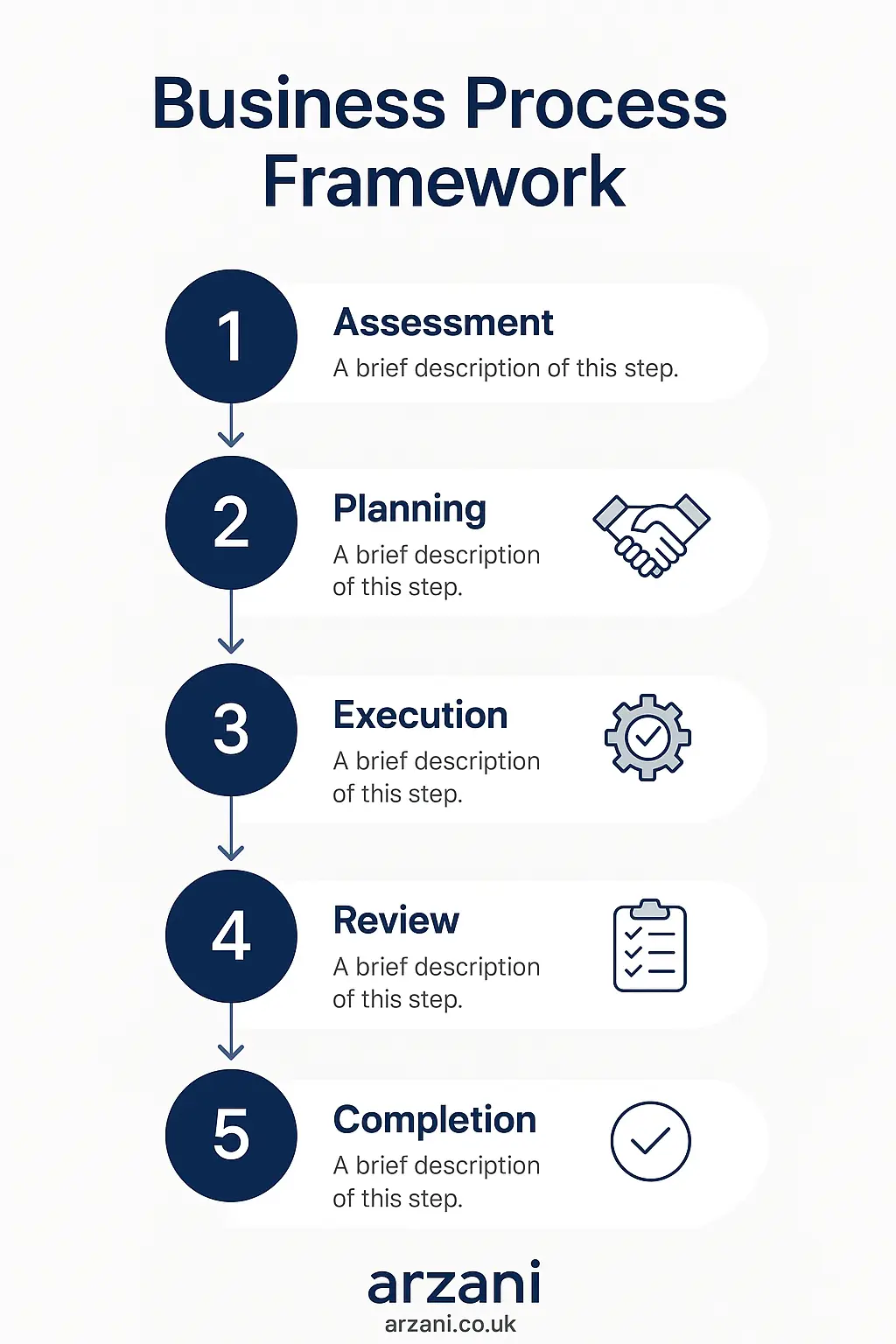

Business Process Framework - Step-by-step business business sale warranty and indemnity process framework infographic

Table of Contents

Understanding Business Sale Warranties

Warranties in business sales act as assurances made by the seller regarding the state of the business at the time of sale. These include statements about financial health, legal compliance. Additionally, operational status. Ensuring these warranties are clearly defined and realistic is crucial to protect both parties from future disputes.

The Role of Indemnity in Business Sales

Indemnity clauses provide a mechanism for compensating the buyer if certain risks arise post-sale. They are a form of risk allocation that ensures any post-completion liabilities are addressed, making them a vital component of the sale agreement. Indemnity insurance in the UK has become a popular tool to cover potential claims, adding an extra layer of protection.

7-Step Warranty and Indemnity Negotiation Framework

- Initial Assessment: Evaluate business risks and potential need for warranties and indemnities.

- Drafting the Agreement: Clearly outline all potential risks and associated warranties.

- Legal Review: Involve legal experts to ensure compliance with UK regulations.

- Negotiation: Engage in discussions to reach mutual agreement on terms.

- Insurance Consideration: Explore warranty and indemnity insurance options.

- Finalization: Finalize terms with all stakeholders.

- Post-Completion Monitoring: Monitor compliance and address any post-sale issues.

Utilizing this framework helps in structuring a clear path for negotiations, enhancing the protection of both parties involved.

UK Market Statistics - UK business sale warranty and indemnity market statistics and data visualization

Case Studies: Real UK Business Transactions

Consider the example of a £1.8M acquisition in the Leeds manufacturing sector. The buyer and seller negotiated a warranty regarding the environmental compliance of the manufacturing processes. After the sale, a breach was identified. Additionally, the indemnity clause effectively covered the rectification costs, showcasing the importance of thorough agreements.

In another case, a £2.5M tech business sale in London involved stringent indemnity clauses related to intellectual property. The buyer discovered post-sale IP infringements. Additionally, due to the indemnity agreement, the seller covered all legal expenses.

Business Timeline - Typical business sale warranty and indemnity timeline and milestones infographic

Frequently Asked Questions

What is a business sale warranty?

A business sale warranty is a promise made by the seller about the condition of the business at the time of sale, covering aspects like financial statements and legal compliance.

How does indemnity insurance benefit UK buyers?

Indemnity insurance provides financial protection against specified risks, ensuring that the buyer is compensated for any breaches of warranty or undisclosed liabilities.

What are common warranties in UK business sales?

Common warranties include assurances about the accuracy of financial records, tax compliance, and the status of assets and liabilities.

How can sellers protect themselves from warranty claims?

Sellers can protect themselves by ensuring full disclosure, negotiating caps on liability, and obtaining indemnity insurance.

What role does legal counsel play in these agreements?

Legal counsel is essential for drafting and reviewing agreements to ensure they meet legal standards and adequately protect both parties.

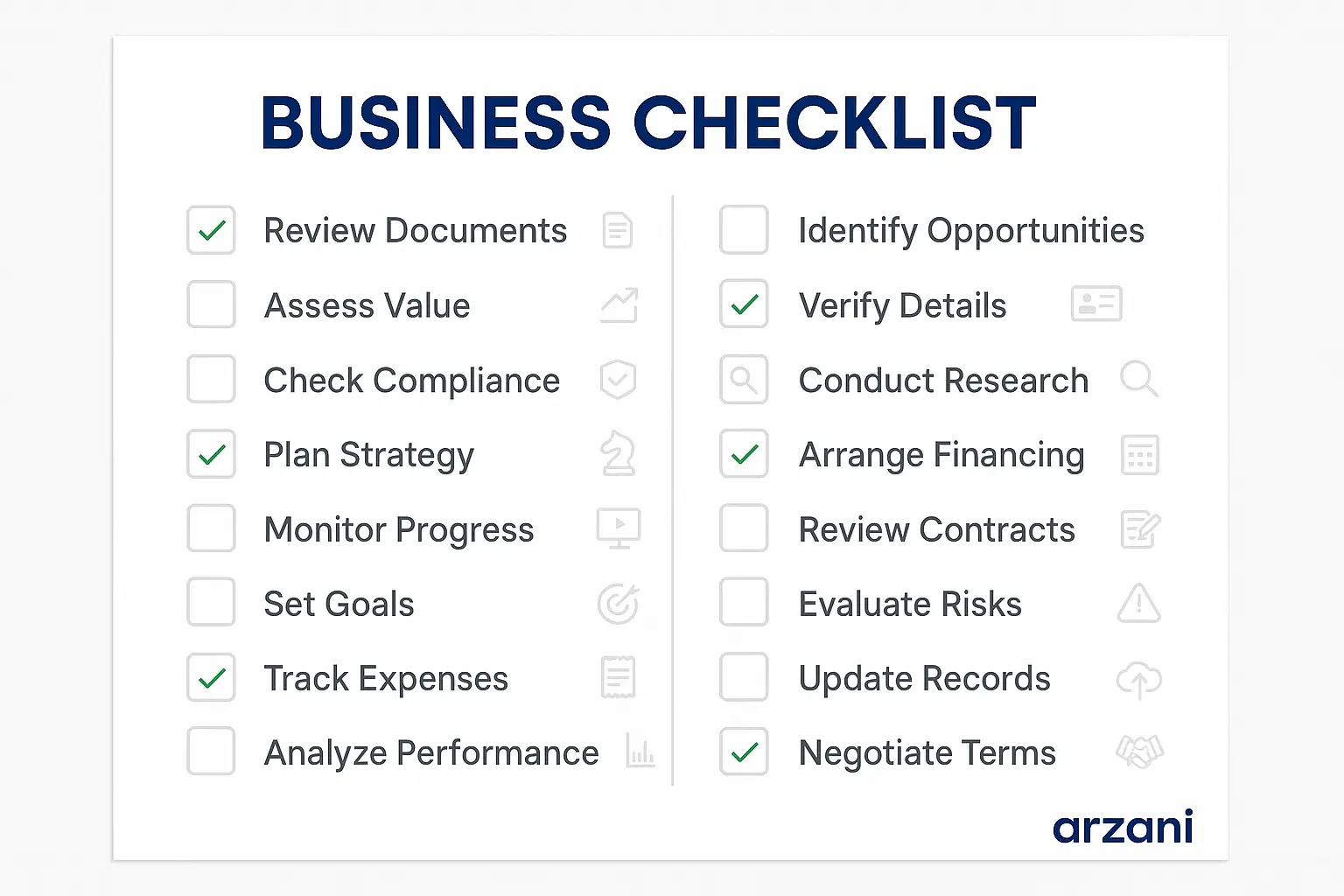

Business Checklist - business sale warranty and indemnity checklist and key considerations infographic

Conclusion & Call to Action

Understanding and effectively negotiating business sale warranty and indemnity is essential for successful transactions in the UK marketplace. By implementing a structured approach and leveraging professional advice, businesses can safeguard their interests and facilitate smoother sales processes. For more insights and assistance, visit Arzani marketplace where expert guidance and resources are available to support your business selling journey.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv