Introduction

In the dynamic landscape of the UK business marketplace, effective business sale tax planning is vital for maximising returns when selling your business. According to the Office for National Statistics, the average value of UK business sales has increased by 12% in 2025, underscoring the importance of strategic tax planning. Understanding the tax implications of selling a business in the UK can significantly impact the net proceeds from the sale.

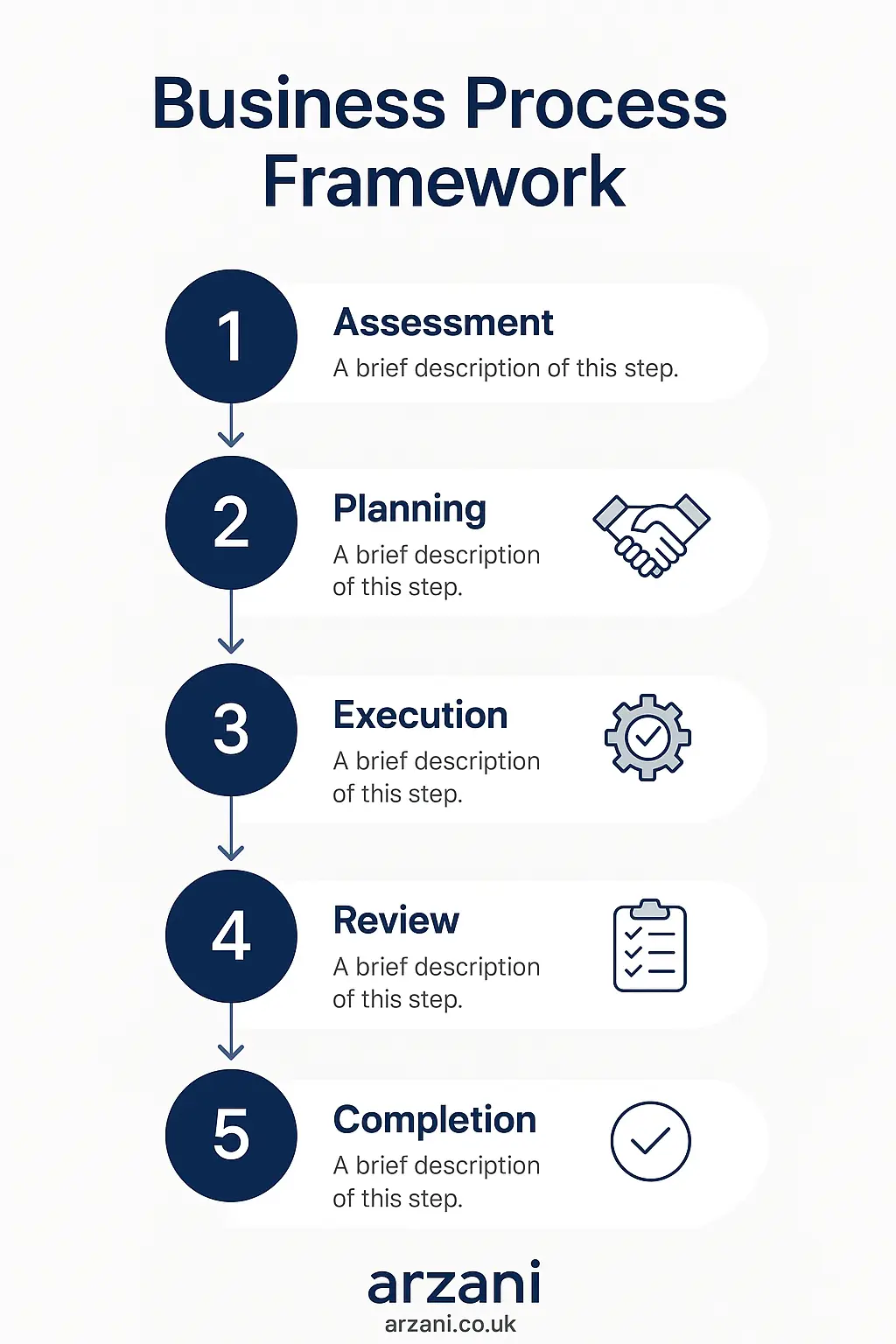

Business Process Framework - Step-by-step business business sale tax planning uk process framework infographic

Table of Contents

Understanding UK Business Sale Tax

Selling a business in the UK involves several tax considerations. Primarily, sellers need to be aware of Capital Gains Tax (CGT). This applies to the profit made from the sale. As of 2025, the standard CGT rate for business asset disposal is 20%. However, relief options such as Business Asset Disposal Relief (BADR), formerly known as Entrepreneurs' Relief, can reduce this to 10% on qualifying gains up to £1 million.

Additionally, sellers must consider the impact of VAT, particularly if the business is sold as a going concern. This can be zero-rated. Understanding these elements is crucial for effective tax planning.

7-Step Business Sale Tax Planning Framework

- Assess Business Valuation: Begin by accurately valuing your business. Engaging with a professional valuer can provide a realistic market price, factoring in assets, liabilities, and earnings.

- Consider Tax Relief Options: Evaluate available tax reliefs such as BADR and Investors' Relief. These can significantly reduce the tax burden on sale proceeds.

- Structuring the Sale: Decide whether to sell shares or assets. The structure can influence the tax payable and should align with your financial goals.

- Plan for VAT Implications: If your business is VAT registered, ensure you understand the VAT treatment. Selling as a going concern can mitigate VAT liabilities.

- Review Legal Requirements: Ensure compliance with Companies House reporting and any sector-specific regulations from bodies like the FCA.

- Engage Professional Advisors: Consult with tax advisors and solicitors to navigate complex tax laws and ensure optimal tax planning.

- Finalise Documentation: Prepare sale agreements and ensure all tax-related documentation is in order for a smooth transaction.

UK Market Statistics - UK business sale tax planning uk market statistics and data visualization

Key Tax Strategies for British Business Sales

Effective tax strategies can enhance the financial outcome of a business sale. Here are some strategies to consider:

- Utilise BADR: Maximise the use of Business Asset Disposal Relief to benefit from a lower CGT rate.

- Pre-Sale Restructuring: Restructure ownership to optimise tax reliefs, such as transferring shares to family members before the sale.

- Defer Tax Payments: Consider payment structures that allow for tax deferral, spreading the tax liability over several years.

- Invest in EIS or SEIS: Reinvest proceeds into Enterprise Investment Scheme or Seed Enterprise Investment Scheme for further tax reliefs.

Case Studies from the UK Market

Example 1: Tech Start-Up in Manchester

In 2024, a tech start-up in Manchester sold for £2.5 million. By utilising BADR, the owner reduced their CGT liability from £500,000 to £250,000, saving a substantial amount.

Example 2: Retail Business in London

A London-based retail business structured its sale to include deferred payments, allowing the owner to spread CGT liability over three years, improving cash flow and tax efficiency.

Business Timeline - Typical business sale tax planning uk timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

Typical multiples for small to medium enterprises (SMEs) in the UK range from 4x to 8x EBITDA, depending on the industry and market conditions.

How does selling shares differ from selling assets?

Selling shares involves transferring ownership of the company, often resulting in different tax treatments compared to asset sales, which involve selling individual business components.

What are the tax implications of earn-outs?

Earn-outs, where part of the sale price is contingent on future performance, may defer CGT liability but require careful structuring to avoid unexpected tax burdens.

Can I avoid Capital Gains Tax entirely?

While avoiding CGT entirely is unlikely, strategic use of reliefs and exemptions can significantly reduce the tax payable. Professional advice is recommended.

What is the role of the HMRC in business sales?

HMRC oversees tax compliance during business sales. Ensuring accurate reporting and payment of due taxes is crucial to avoid penalties.

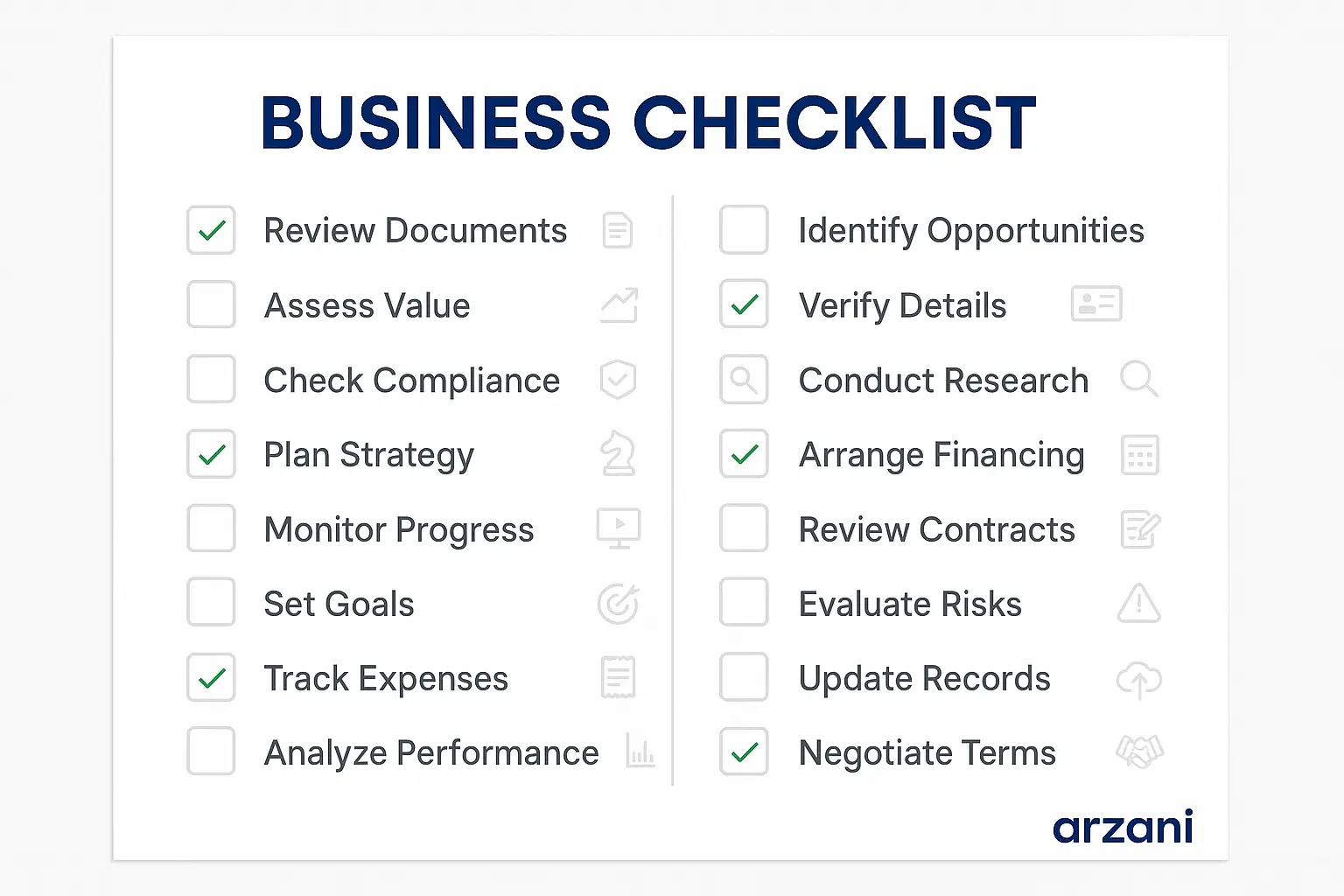

Business Checklist - business sale tax planning uk checklist and key considerations infographic

Conclusion

In conclusion, effective business sale tax planning in the UK requires a comprehensive understanding of tax implications and strategic use of available reliefs. By following a structured framework and engaging with professional advisors, sellers can maximise their net proceeds and ensure compliance with regulatory requirements. For more insights and assistance with your business sale, visit Arzani Marketplace to connect with experts in the field.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv