Introduction

In the dynamic landscape of the UK business marketplace, negotiating effective business sale earnout structures is crucial for both buyers and sellers. With the current economic climate showing a 15% increase in business transactions as per the Office for National Statistics, understanding how to leverage earnouts can significantly impact the success of selling a business. This article delves into the intricacies of UK business earnout agreements, providing a comprehensive framework for navigating these complex arrangements.

Business Process Framework - Step-by-step business business sale earnout structures uk process framework infographic

Table of Contents

Understanding Earnouts in Business Sales

Earnouts are financial arrangements where the seller receives additional payments post-sale if the business achieves specified performance targets. These are particularly common in sectors with high growth potential, such as technology and pharmaceuticals. The key to a successful earnout agreement is clarity, ensuring that both parties have agreed upon measurable targets and timelines.

Benefits and Risks of Earnouts

Benefits include aligning the seller’s incentives with the future success of the company, while risks involve potential disputes if targets are not met. It is vital to draft these agreements carefully to mitigate misunderstandings.

Legal Considerations

Under UK law, earnouts must comply with legal standards set by the Companies House and may be subject to taxation. This can affect the final payout. Consulting a legal professional with experience in UK business sales is advisable.

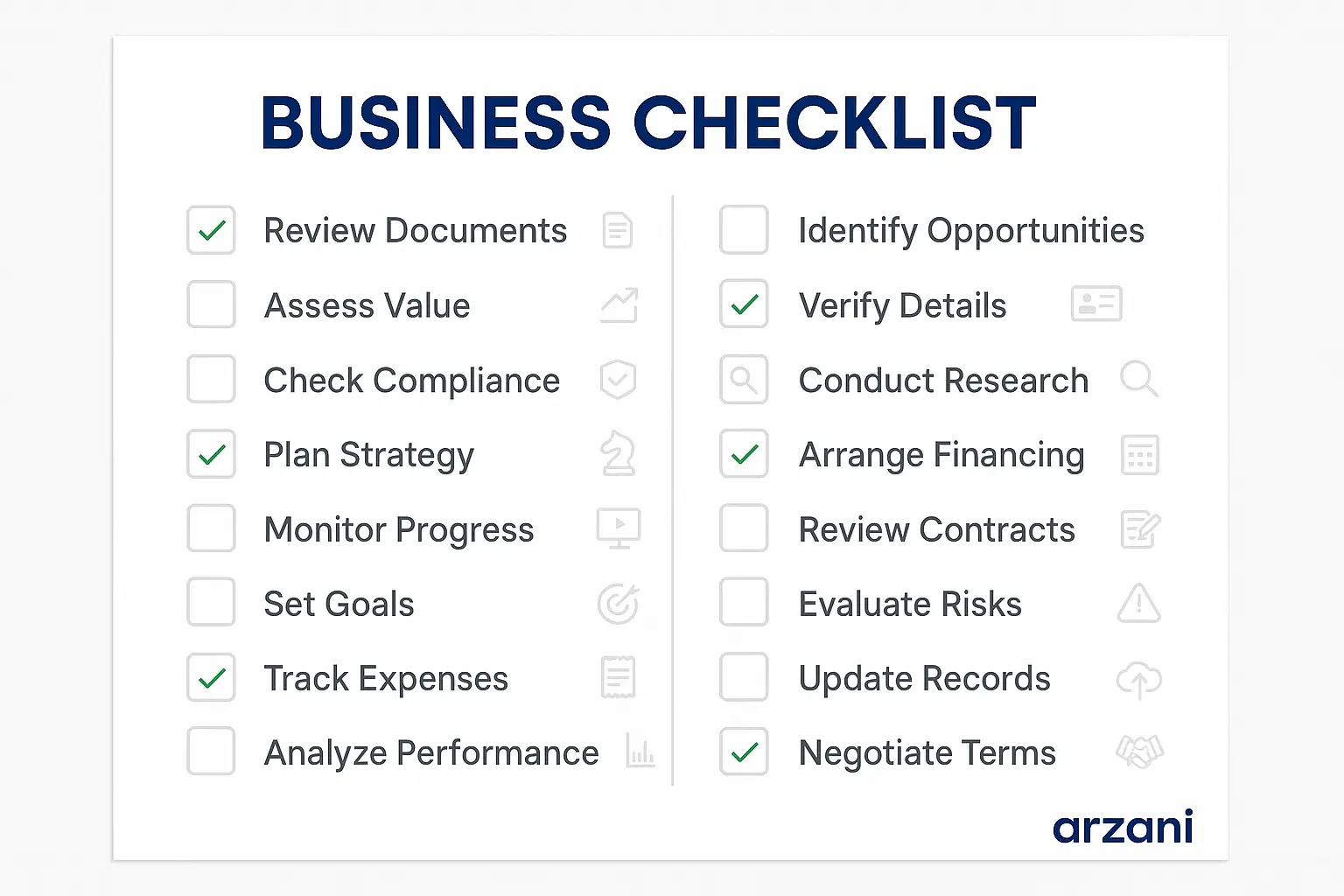

7-Step Earnout Negotiation Framework

- Initial Agreement: Clearly outline the business's current performance metrics.

- Define Targets: Set realistic and achievable performance goals.

- Timeline Establishment: Agree on a timeline for achieving these targets.

- Valuation Methodology: Decide on an appropriate method for valuing performance improvements.

- Payment Structure: Determine how and when payments will be made.

- Dispute Resolution: Include a clause for resolving potential disagreements.

- Documentation: Ensure all agreements are formally documented and signed.

UK Market Statistics - UK business sale earnout structures uk market statistics and data visualization

Detailed Case Studies

Case Study 1: Tech Startup Acquisition

A £2 million tech startup sale in London included a 20% earnout based on achieving £500,000 in new contracts within the first year post-acquisition. The earnout was successfully paid, demonstrating the effectiveness of clear target setting.

Case Study 2: Manufacturing Firm Sale

In Manchester, a manufacturing firm was sold for £5 million with a £1 million earnout contingent on a 10% increase in production efficiency. The targets were not met due to market changes, highlighting the importance of adaptable earnout clauses.

Business Timeline - Typical business sale earnout structures uk timeline and milestones infographic

Frequently Asked Questions

What is a typical earnout period in the UK?

Typically, earnout periods range from 1 to 3 years, depending on the industry and market conditions.

How are earnout payments taxed in the UK?

Earnout payments may be subject to capital gains tax or income tax. It is important to consult with a tax advisor for specific guidance.

What happens if the business does not meet earnout targets?

If targets are not met, the earnout payments may be reduced or forfeited, depending on the agreement terms.

Can earnouts be renegotiated?

Yes, earnouts can be renegotiated if both parties agree, especially if there are significant changes in business or market conditions.

Are earnouts common in all industries?

Earnouts are more common in industries with high growth potential, such as tech and life sciences, where future performance is uncertain.

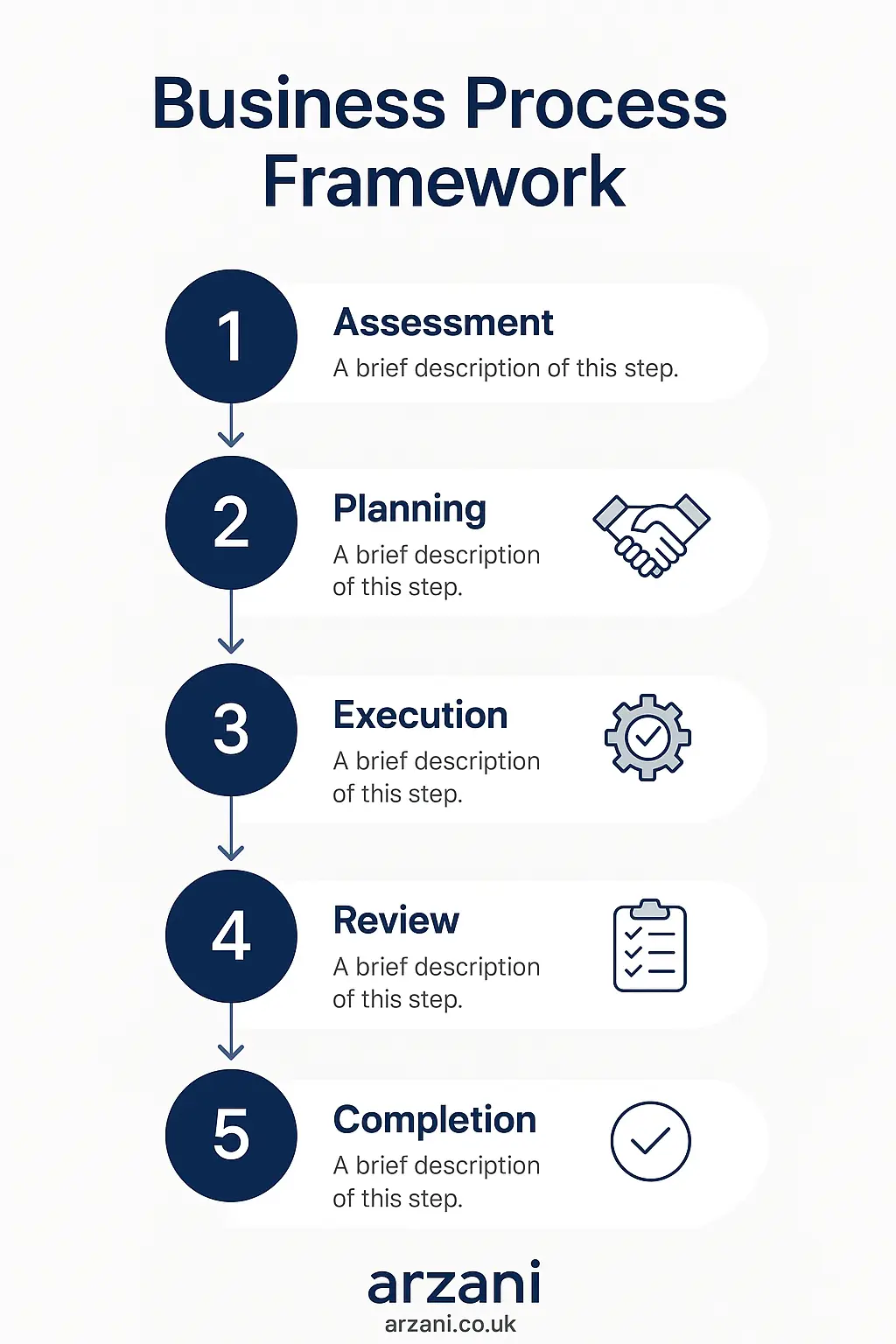

Business Checklist - business sale earnout structures uk checklist and key considerations infographic

Conclusion & Call to Action

In conclusion, earnouts can be a powerful tool in selling a business in the UK, offering potential benefits for both sellers and buyers. By carefully structuring earnouts, setting clear goals. Additionally, understanding the legal and financial implications, businesses can maximize the potential of these agreements. For further assistance in navigating the complexities of business sales, visit arzani.co.uk to explore our marketplace options and expert consultancy services.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv