Introduction

In the competitive landscape of the UK business marketplace, managing confidentiality during a business sale is paramount. With the volume of business sales increasing by 15% in 2025 according to ONS, safeguarding sensitive information during negotiations is vital to maintaining value and ensuring a successful transaction. This guide will explore the intricacies of business sale confidentiality and provide actionable insights to navigate the process effectively.

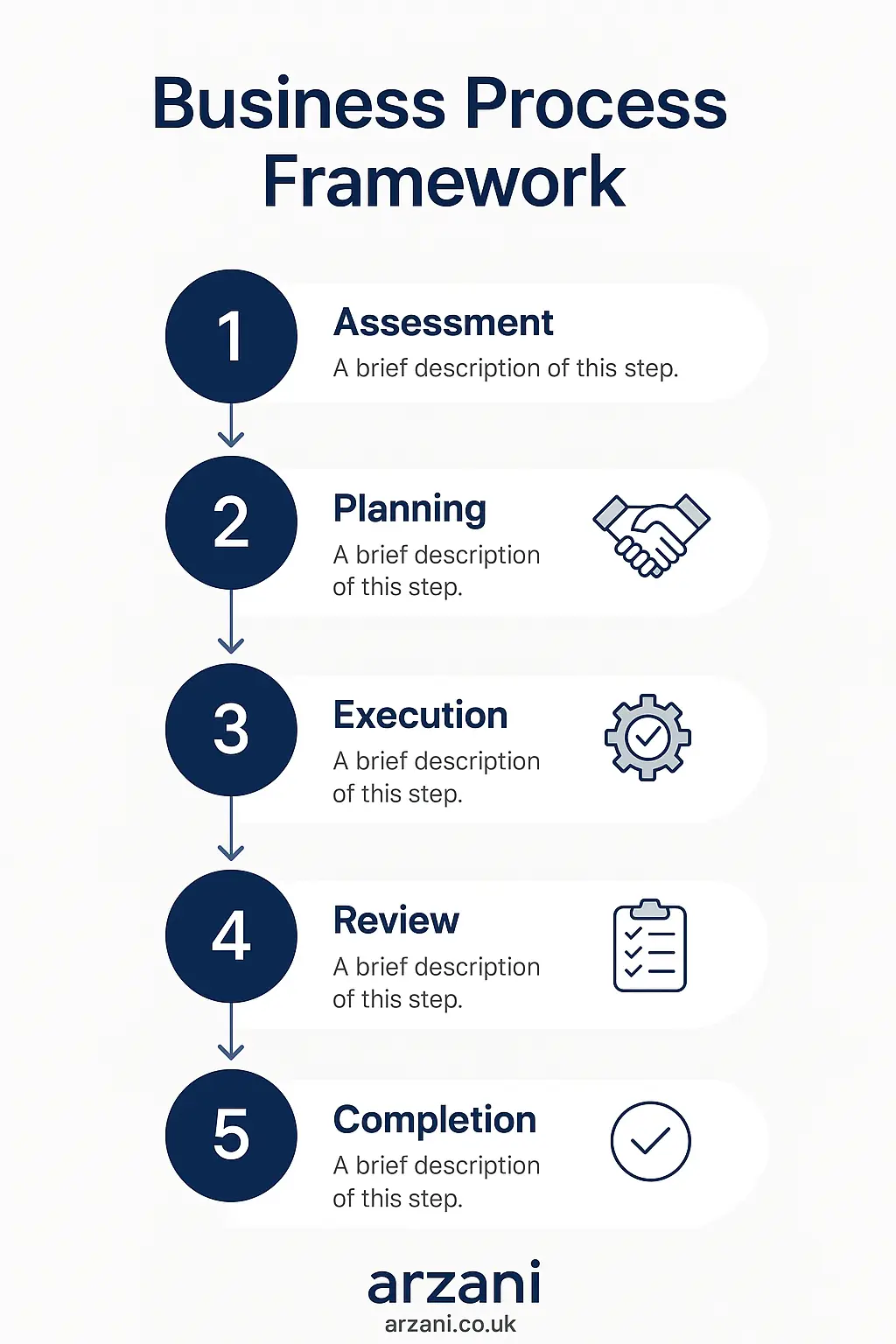

Business Process Framework - Step-by-step business business sale confidentiality process framework infographic

Table of Contents

Understanding Confidentiality in Business Sales

Confidentiality is a cornerstone of the business selling process. It ensures that sensitive information does not reach competitors or affect the business’s market position negatively. In the UK, confidentiality agreements, often referred to as non-disclosure agreements (NDAs), are legally binding documents crucial in safeguarding business interests.

Key Components of a Confidentiality Agreement

- Parties Involved: Clearly identify all parties involved in the agreement.

- Definition of Confidential Information: Specify what constitutes confidential information.

- Exclusions: Outline what information is not considered confidential.

- Obligations: Duties of the receiving party regarding the handling of information.

- Term: Duration for which the confidentiality is maintained.

- Consequences: Legal ramifications in case of a breach.

7-Step Framework for Managing Confidentiality

Managing confidentiality effectively during a business sale involves a strategic approach. Here are seven steps to ensure your confidentiality protocols are robust:

- Initial Assessment: Determine the sensitivity of the information and the potential impact of disclosure.

- Drafting the NDA: Work with legal experts to draft a comprehensive confidentiality agreement.

- Internal Training: Educate your team on the importance of confidentiality and procedures to follow.

- Controlled Disclosure: Limit the access to sensitive information to essential personnel only.

- Secure Communication Channels: Use encrypted methods for sharing confidential information.

- Regular Audits: Conduct periodic audits to ensure compliance with confidentiality agreements.

- Contingency Planning: Establish a response plan for potential breaches of confidentiality.

UK Market Statistics - UK business sale confidentiality market statistics and data visualization

Real-World Case Studies

Case studies provide invaluable insights into how confidentiality is managed during business sales. Here are two anonymized examples from the UK market:

Case Study 1: Tech Startup Sale

A £2.5 million tech startup sale in Manchester involved extensive confidentiality measures. The NDA covered all proprietary technology details, ensuring competitors did not gain an advantage, ultimately leading to a smooth transition.

Case Study 2: Retail Chain Acquisition

In a £5 million acquisition of a retail chain in London, confidentiality agreements were pivotal in maintaining employee morale and operational stability during the sale process. The strategic use of NDAs prevented leaks that could have disrupted business operations.

Business Timeline - Typical business sale confidentiality timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

Multiples vary but typically range from 3x to 5x EBITDA for small and medium enterprises in the UK. Factors such as industry, growth potential. Additionally, market conditions play a significant role.

How does a confidentiality agreement protect my business sale?

An NDA legally binds all parties to keep sensitive information secret, protecting trade secrets and proprietary information from competitors and market disruptions.

Can a confidentiality breach impact the sale?

Yes, a breach can lead to loss of competitive advantage, valuation decrease, and potential legal actions, ultimately affecting the sale's success.

Are NDAs enforceable in the UK?

Yes, NDAs are legally enforceable in the UK, provided they meet all legal requirements and are not overly restrictive or unfair.

What steps should I take if a breach occurs?

Immediately enact your contingency plan, notify legal counsel, and assess the impact. Consider pursuing legal action if necessary.

How long does confidentiality last post-sale?

The duration is specified in the NDA, typically ranging from 1 to 5 years, depending on the sensitivity of the information.

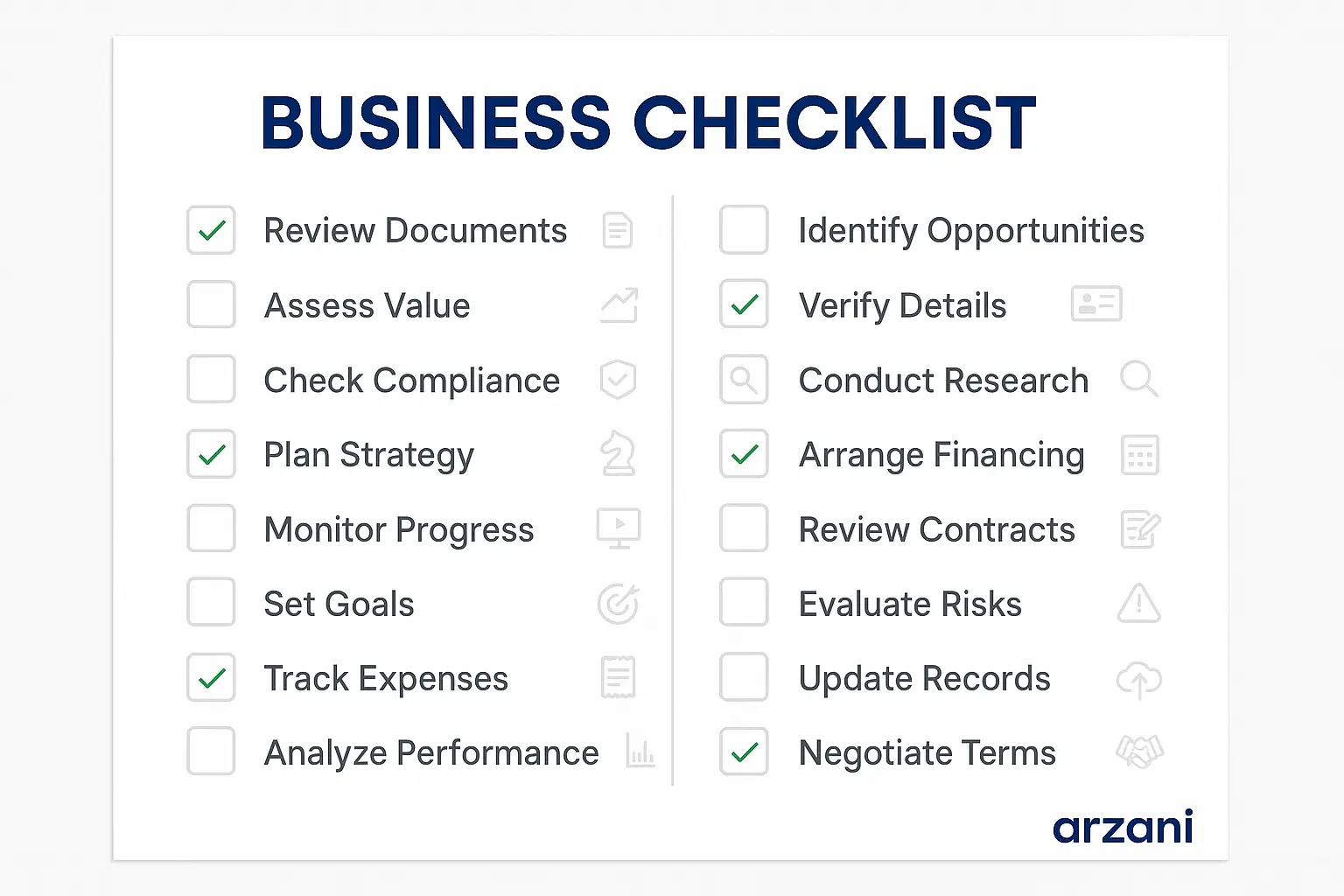

Business Checklist - business sale confidentiality checklist and key considerations infographic

Conclusion & Call to Action

Understanding and managing business sale confidentiality is crucial to safeguarding your interests and ensuring a successful transaction. By following our 7-step framework, you can enhance your confidentiality measures and mitigate risks. For more insights and to explore business opportunities, visit Arzani Marketplace today and take advantage of our expert resources.

Author Bio

John Arzani is a seasoned business consultant with over 20 years of experience in the UK business marketplace. As the founder of Arzani Marketplace, John has facilitated transactions worth over £50 million, providing expert guidance on business sales and acquisitions. His deep understanding of market dynamics and regulatory frameworks ensures clients receive top-tier advice tailored to their unique needs.

For more details, connect with John at arzani.co.uk where you can find additional resources and expert consultation services.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv