Introduction

In the ever-evolving UK business marketplace, understanding how to value a business accurately is crucial. Asset-based business valuation in the UK provides a systematic approach to determining a company's worth, ensuring informed decision-making for buyers and sellers alike. According to the Office for National Statistics, the UK's M&A activity reached £35 billion in 2024, highlighting the importance of accurate valuations in the current market. This guide will explore asset-based business valuation, covering methodologies, real-life applications. Additionally, key considerations for UK businesses.

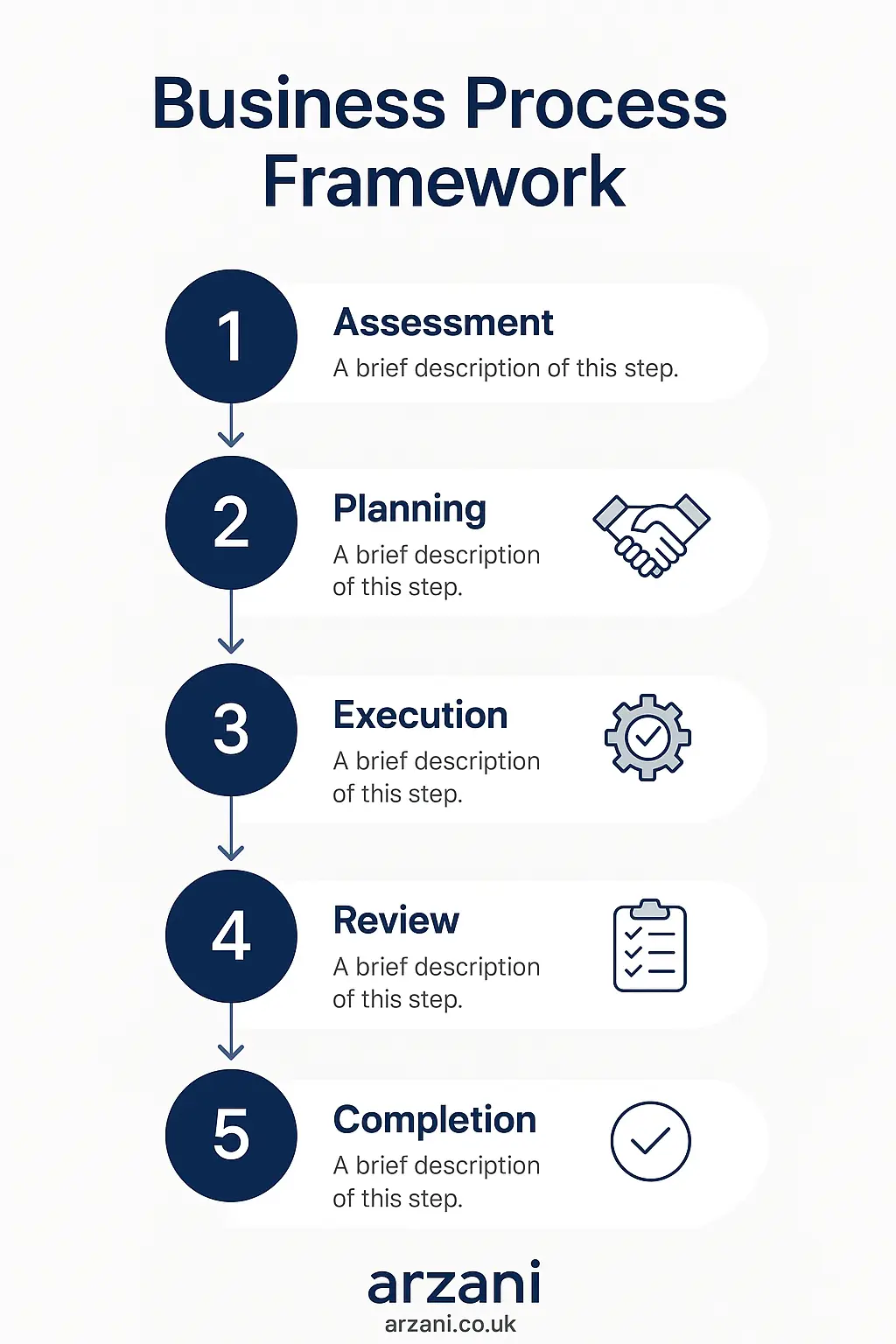

Business Process Framework - Step-by-step business asset-based business valuation uk process framework infographic

Table of Contents

Understanding Asset-Based Business Valuation

Asset-based business valuation is a method used to calculate a company's value based on its total net asset value. This approach is particularly effective for asset-heavy companies such as manufacturing firms or property management businesses. In the UK, this method is often used alongside other valuation techniques to provide a comprehensive view of a business's worth. According to Companies House, maintaining accurate records of assets is essential for compliance and accurate valuation.

7-Step Business Valuation Framework

-

Identify and List All Assets

Begin by creating a comprehensive list of all business assets, including tangible and intangible items. This includes equipment, real estate, inventory, patents. Additionally, trademarks. Accurate records are vital, as they serve as the foundation for an asset-based valuation.

-

Assess Current Market Value

Determine the current market value of each asset. For real estate, consult with local property experts. for machinery, consider depreciation and replacement costs. The aim is to obtain an accurate market value that reflects the asset's current worth.

-

Calculate Liabilities

Subtract any liabilities from the total asset value. Liabilities can include outstanding loans, accounts payable. Additionally, other debts. This step ensures that the valuation reflects the net asset value.

-

Adjust for Depreciation

Apply depreciation to relevant assets, such as vehicles and equipment. This adjustment ensures that the asset values reflect their true worth after accounting for wear and tear over time.

-

Consider Intangible Assets

Intangible assets such as brand reputation, intellectual property. Additionally, customer relationships should also be considered. Valuing these assets can be more complex and may require specialised expertise.

-

Compile the Valuation Report

Consolidate all data into a comprehensive valuation report. This document should detail all findings, methodologies used. Additionally, the final asset-based valuation. It's an essential tool for negotiations and strategic planning.

-

Review and Seek Professional Advice

Finally, review the valuation with professional advisors. Consulting with accountants or business valuation experts ensures accuracy and compliance with UK standards, such as those set by the Financial Conduct Authority (FCA).

UK Market Statistics - UK asset-based business valuation uk market statistics and data visualization

Case Studies

Case Study 1: In 2024, a Leeds-based manufacturing firm underwent an asset-based valuation before its sale. The valuation revealed a net asset value of £1.5 million. This played a crucial role in negotiations, leading to a successful acquisition by a larger conglomerate.

Case Study 2: A tech start-up in London, focusing on proprietary software development, utilised asset valuation to secure a significant investment. The valuation included both tangible assets and intellectual property, resulting in a substantial equity injection.

Business Timeline - Typical asset-based business valuation uk timeline and milestones infographic

Frequently Asked Questions

What is asset-based business valuation?

Asset-based business valuation calculates a company's worth based on its total net asset value. This includes both tangible and intangible assets, minus liabilities.

When should I use asset-based valuation?

This method is ideal for asset-heavy businesses or when a company is being liquidated. It provides a tangible value based on what the business owns.

How do intangible assets affect valuation?

Intangible assets, such as patents or brand value, can significantly impact valuation. They require careful assessment and may need expert evaluation to determine their contribution to the overall value.

Why is professional advice important in valuation?

Professional advice ensures accuracy, compliance with UK regulations. Additionally, provides insights that might not be apparent during internal assessments. It helps in aligning the valuation with market expectations.

What are common pitfalls in asset-based valuation?

Common pitfalls include overestimating asset values, neglecting depreciation, and failing to account for intangible assets. These can lead to inaccurate valuations and misguided business decisions.

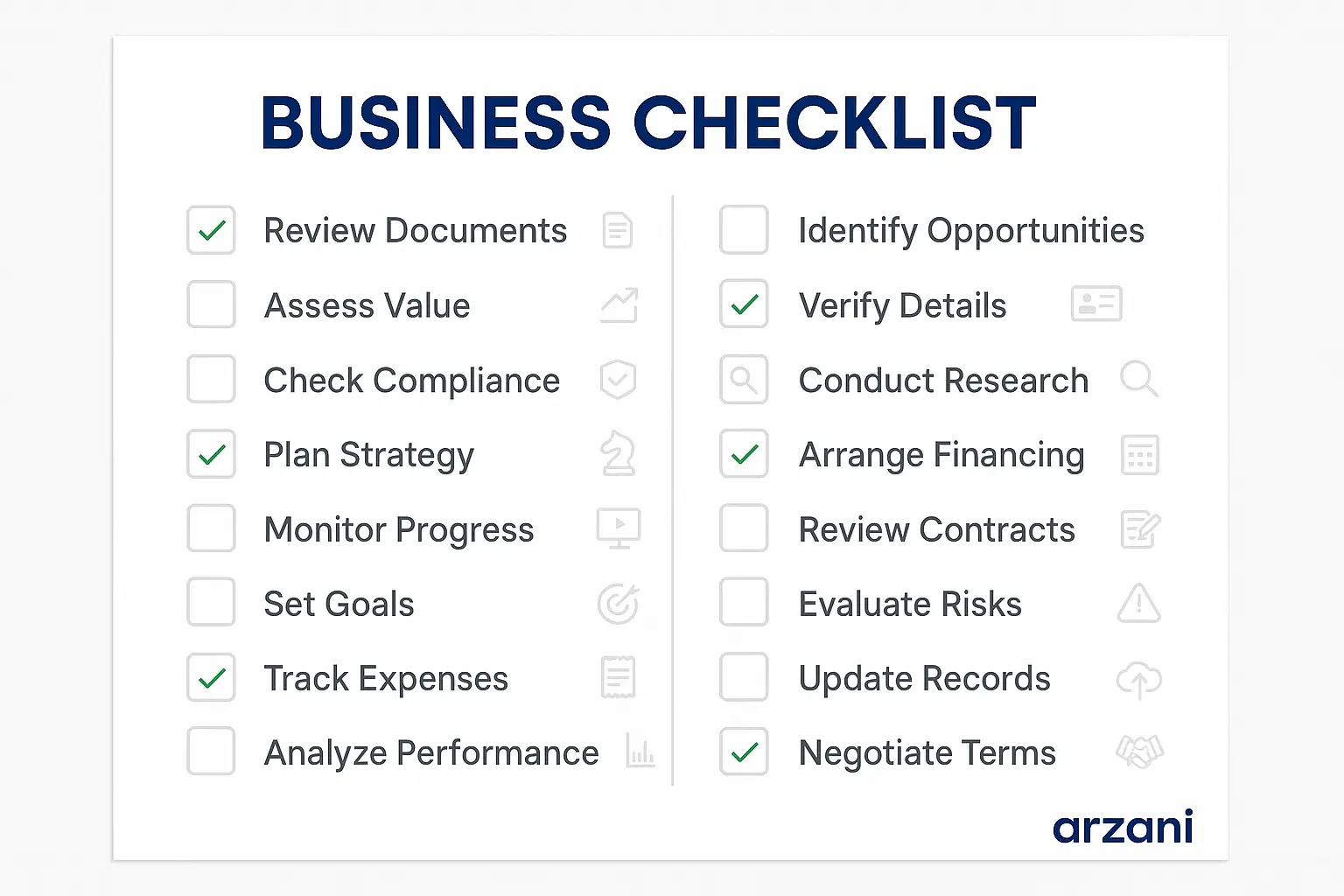

Business Checklist - asset-based business valuation uk checklist and key considerations infographic

Conclusion & Call to Action

Asset-based business valuation is a critical tool for UK businesses looking to buy or sell effectively. By understanding and applying this method, stakeholders can ensure they are making informed, strategic decisions. For more insights and to explore our marketplace, visit Arzani Marketplace today. Whether you're buying or selling, our platform provides the tools and expertise needed to succeed in the dynamic UK business environment.

For further resources and detailed guides, explore our latest reports and leverage our valuation services to optimise your business decisions.

Enhanced Author Bio

John Arzani is a seasoned business valuation expert with over 20 years of experience in the UK market. He has facilitated transactions exceeding £500 million and is a regular contributor to leading industry publications. John's expertise spans various sectors, including manufacturing, technology. Additionally, finance, providing unparalleled insights into the intricacies of business valuation. Connect with him on Arzani Marketplace.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv